Given the flurry of heated discussion on the topic of ‘peak oil‘ on another BNC post, I invited one of the protagonists, Dave Lankshear (a.k.a. “Eclipse Now” — see here for his blog), to write up a summary piece which described his position on the topic. This is given below, and should provide a good context for discussion; I also hope that this thread will help corral comments on this topic to a central point.

Given the flurry of heated discussion on the topic of ‘peak oil‘ on another BNC post, I invited one of the protagonists, Dave Lankshear (a.k.a. “Eclipse Now” — see here for his blog), to write up a summary piece which described his position on the topic. This is given below, and should provide a good context for discussion; I also hope that this thread will help corral comments on this topic to a central point.

For earlier posts on BNC regarding peak oil (all done, incidentally, prior to BNC’s nuclear awakening), see:

Olduvai theory – crackpot idea or dawning reality?

Beyond peak oil – will black gold turn green?

I made some comments on the other comments thread about my position. To paraphrase: a fundamental problem with arguing that authorities like the IEA, EIA and ABARE are overlooking the looming ‘peak oil crisis’ is that so far, they have been correct — at least in the sense that it hasn’t yet happened, just like they predicted (or at least if it has, its ramifications to date on oil prices and availability have been minimal). As such, their predictions which ignore peak oil are, on the bald face of it, justified. Peak oil HAS happened in limited jurisdictions (including the US), but has always, to date, been compensated for by imports, or gas substitutes, other technological improvements etc., such that no nation has so far gone from being an high oil consumer to a low oil consumer on the back of peak oil.

Now I’m not making the argument here that peak oil is an invalid concept — at least regionally — and I’m not even arguing that it’s not a potentially serious future issue for which we ought to be preparing to counter now. But as far as authoritative energy bodies have been concerned, they currently have nothing to hang their heads in shame over in that regard. They’ve got it right. If they are right by luck, and misfortune is about to strike Australia and other industrial nations any time soon, then we may well curse their lack of foresight. But that’s a big IF, and there are many eminent people, including Prof Richard Hillis at my own University, who argue that by the time rising oil prices is a really serious issue, alternatives and substitutes will have been found, as they always have before. Price, they argue, will always be the principal driver of innovation. (In passing I note that this is the reason I argue that full recycling of used nuclear fuel has not yet taken hold with any real enthusiasm — mined uranium is still too cheap).

Anyway, now on to EN’s comprehensive primer, from a ‘peakist’s’ perspective…

——————————-

On peak oil authorities

by David Lankshear (Eclipse Now), Peak oil activist since 2004

Background

Recent debate on BNC has focussed on the issue of the reliability of government energy authorities in regards to the global peak oil debate. As someone with a mere Social Sciences background and no technical training, I was asked to submit an article on why I have the audacity to hold certain ‘energy authorities’ with a high degree of suspicion. Was it all just paranoid conspiracy theories I absorbed from the net? Or is there something fundamentally wrong with the way our governments have been informed regarding our most important resource, oil?

Introduction to peak oil

In the last 5 years a handful of new government sponsored reports and agencies have suddenly sprung to address an urgent question. Are we suddenly facing the final oil crisis? Are we only years from the beginning of the end of the oil age? Has it already begun? With Scientific American just today predicting global peak oil by 2014 [1], how did we come to be asking such an important question so late in the picture?

But first a quick-catch up to newcomers not familiar with the term ‘peak oil’. Oil fields tend to ramp up in production as new wells are drilled and the full size of the field is confirmed. But after about half the oil has been pumped out, production stabilises… and eventually declines. It’s to do with oil pressure, which forces the first oil out at high speed. We’ve all seen iconic images of drills ‘striking oil’ where the gusher shoot high into the air. But once enough oil is pumped, the pressure goes down. The going gets tough. Think about sucking on an ice-cone slurry. The first half is fast and thick and juicy, the second half is hard work and slow and watery. The life of an oil field is just like that, but spread out over years or even decades. For a further introduction to peak oil the ABC has some brilliant free online movies to watch, starting with Catalyst [2], Crude [3], and Four Corners [4]. Or you can read the Peak Oil Primer at Energy Bulletin [5].

The history of peak oil in one minute

In 1956 M. King Hubbert (wiki) famously stood up at the American Petroleum Institute seminar, and predicted that within 14 or so years American oil would reach its maximum production or ‘peak’ and then begin to decline. Hubbert was laughed off the stage, as the American oil industry had pumped exponentially more oil every year for decades, with no end in site. As time rolled on and 1970 rolled around, the oil industry laughed at Hubbert and claimed “We’ve never pumped so much oil!” The irony was they never would again, as 1970 was the year they peaked.

How did he do it? In extremely simple terms, you have to find oil before you can pump it. Hubbert noticed that the discovery of oil in America had peaked and declined, and with a little math could plot when the exponentially growing consumption of oil would follow the same pattern. Watch this 2 minute youtube clip as an illustration.

Of course this was a vastly complex data management issue involving thousands of wells and production profiles, but that’s it in a nutshell. Hubbert then made a stab at world peak oil, which he predicted for 1995. But the world soon forgot. Other than Limits to Growth and a smattering of articles here and there, the world assumed we would all be flying “Mr Fusion” powered hover-cars with Marty McFly. This was all ‘in the future’, and something would turn up by then!

New authorities challenge the old

The peak oil discussion started up again in earnest when lifetime geologists Colin Campbell and Jean H. Laherrère wrote a 1998 article for Scientific American, The End of Cheap Oil. [6]. This article re-ignited the debate. It carries the weight of two grandfathers of the oil industry. Other geologists craved a clearer, more scientific approach than was currently being practised by the official government agencies. Colin Campbell eventually founded the Association for Peak Oil and Gas (ASPO) at Uppsala University, Sweden [7]. This university think tank receives papers from all the ‘good old boys’ of the oil industry, veterans with a lifetime on the front line of oil exploration and production. They have a range of publications [8] in everything from newspapers and magazines, academic theses, through to peer-reviewed works [9]. This coalition of oil professionals and professors is was the first Association to present peak oil as a scientific case unfettered by economic bias.

Joining ASPO is an act of rebellion against the status quo. These experts are taking a stand against the might of the USGS, and all those agencies the USGS advises. This includes the American Department of Energy (DOE) and their sub-agency, the Energy Information Agency (EIA).

Even international concerns depend on the USGS. The International Energy Agency (IEA) was set up by the OECD after the 1970′s oil crisis. The IEA advises Australia on the international oil situation as well. (ABARE focus on our domestic resource issues. Dr Brian Fisher indicated to Four Corners [4] that he felt ABARE had not been commissioned to report on the international oil scene, even though it advises the Australian government on the oil price.)

ASPO is even winning sceptics in this titanic battle. Lifetime oil professionals are shifting from trusting the USGS to battling them in the peer reviewed literature. One such person was Chris Skrebowski (wiki):

Chris has 38 years experience in the Oil Industry, starting work in 1970 as a long-term planner for BP. His career has been divided between industry planning/market analysis and oil journalism. He was Senior Analyst for the Saudi Oil Ministry in London (1985-1994) , Editor of Petroleum Economist (1994-97) [8] and Editor of Petroleum Review (1997-2008)[9]

Chris now questions the USGS methodology [10], writes extensively to the UK Parliament about the dangers of peak oil, and formed the All Party Parliamentary Group on Peak Oil and Gas (APPGOPO). As this coalition of geologists and energy experts grows and forms their own consensus that peak oil is imminent, the contrast with the established authorities could not be more profound. It is as if the world’s climatologists had reached a consensus on global warming with the IPCC all along rejecting it!

What are the main arguments that are convincing the likes of Chris Skrebowksi to abandon the ‘IPCC’ of oil, the USGS?

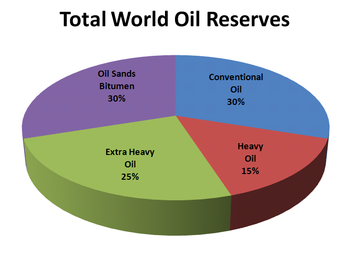

1. The USGS uses incorrect categories

Campbell and Aleklett [11] explain how the term ‘Proved’ reserves evolved in the unique historical setting of early Texas drilling. In this chaotic environment back in the heyday of American oil exploration, it was not unreasonable to simply multiply annual production volumes by 10 to give a rough ‘Proved’ resource. But today we use seismic mapping technologies that give a far more accurate estimation in the first place, and so using this ‘Proved’ formula can artificially inflate reserve estimates.

Unfortunately the world also has a variety of definitions of ‘Proved’ and ‘Probable’ and ‘Possible’ reserves, which also confuse the real story. Half the battle for accuracy seems to focus on terminology alone.

Campbell shows some respect for decades of US Geological Survey work right up until the 2000 report. Then it all went horribly wrong. The USGS inappropriately extrapolated specifically American categories to the rest of the world. Not only that, but magical technological improvements were assumed to allow ‘reserve growth’ – getting more out of existing fields – by an astonishing 76%! Economic paradigms were forced over the data. As Campbell and Aleklett explain in their abstract:

…what may be called the Flat-Earth Approach, in which the resource is deemed to be virtually limitless, with extraction being treated as if it were controlled only by economic, political and technological factors.

The University of Reading study by Bentley also raises concerns about the categories used [12].

2. It doesn’t work

The USGS 2000 study doesn’t work in practice. The USGS have such a vastly inflated estimate of the oil on this planet that their projected discovery rates were double what actually occurred in the real world [11].

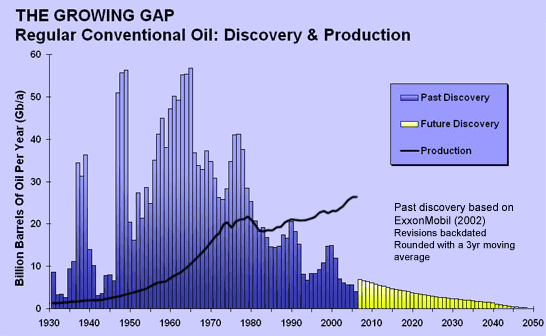

3. The Growing Gap: those ‘twin peaks’ appear again

As we saw above, Hubbert predicted American peak oil from the ‘twin peaks’ of the discovery bell curve forecasting the consumption bell curve. We can now clearly see the same pattern unfolding on the world stage, as modelled by ASPO from Exxon Mobil data [13].

Discovery peaked way back in 1965, 45 years ago. Also note that as production keeps climbing, discovery keeps dying. The last time we found more oil than we burned was in the early 1980’s. A whole generation has been born, educated, attended university and entered the workforce since we stopped even finding as much oil as we burn each year. We now burn 4 or 5 times more than we find, and are eating into the oil our grandparents discovered. The discovered volumes of oil look quite high compared to our current consumption peak, it is a tricky thing to judge visually. The experts have to mathematically ‘smooth out’ the already discovered oil to supply the world’s oil on the downside of the consumption bell curve, just as Hubbert did back in 1956 to predict the American peak of 1970. ASPO add their more grounded future discovery trends and come to an Ultimately Recoverable Reserve (URR) figure. Apply this to the bell curve, and we get the peak somewhere in this decade. I call this the ‘working from the end’ method.

4. Megaprojects — looking forward

This is in contrast to the forward estimates method of Chris Skrebowski. As his wiki says:

Initially sceptical about Peak Oil predictions,[4] he was persuaded by Colin Campbell of the unreliability of oil reserves data and the risks this posed to energy supply projections.[5] His insight was to recognise that future production flows, rather than oil reserves, were the key determinant of global oil supply. Consequently, he developed Peak Flow Analysis based on the future oil flows identified in his own Global Oil Megaprojects Database[6]. Using this methodology he concluded that major supply/demand imbalances would occur by 2007 with actual Peak Oil flows occurring no later than 2011[7].

The Megaprojects report is a database of the performance of every megaproject, or oil field that pumps over 100 thousand barrels a day [14]. The whole of Australia’s current production would only add up to about 4 of these fields. We are a drop in the ocean. The world needs the equivalent of 840 ‘megaprojects’, or 84 million barrels a day!

Aleklett claims we now live in a world where 54 out of the top 65 oil producing nations have already peaked [15]. These fields are now permanently producing less oil every year. Skrebowski’s concern is to look ahead, and forecast the ability of the new megaprojects that start each year to offset the oil we lose each year. Skrebowski published his Megaproject Reports in the prestigious Petroleum Review [16]. He is also responsible for variety of magazine articles, video conferences, and podcasts with his ODAC group in the UK. Dr Fredrik Robelius wrote his Phd thesis to also focus on how tracking trends in the world’s super-giant fields alone proves peak oil to be imminent. [17]

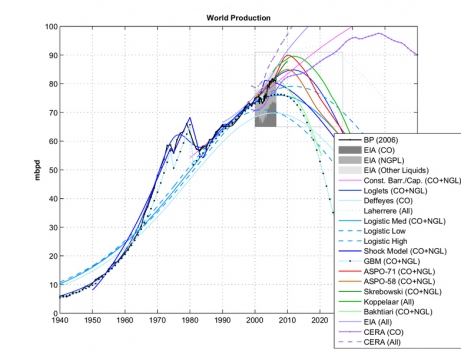

5. The consensus is growing — and grouping around this decade

The Australian Federal Senate Committee showed in Chapter 3.86 that many other significant geologists, energy companies, and even energy investment bankers have also disagreed with the USGS 2000 study [18]. A graph from the Peak Oil wiki also illustrates the point.

6. The USGS is under review

The word is spreading. The IEA now appears to be reviewing their practice of relying on the USGS for oil data [19]. A senior IEA official has even warned the Guardian of undue American influence in denying peak oil in the IEA [20]. And government’s are starting to hold their own independent inquiries, such as the American DOE’s Hirsch Report [21], the UK’s APPGOPO and of course Australia’s own Senate Committee [18].

7. OPEC hidden

ASPO and the other major peak oil agencies and authors doubt OPEC’s reporting. We had over 30 years of Western oil companies surveying Saudi Arabia before the oil industries were nationalised in 1970 and Western nations were banned. Since then, they want us to believe they have conveniently discovered exactly much oil as they have pumped over the last 40 years of production! Only they don’t let Western nations audit their fields. Robert Hirsch put it best when he told Four Corners [4]:

ROBERT HIRSCH, CONSULTANT US DEPT OF ENERGY: Basically, what they’re asking us to do is to trust them. And, frankly, on something that’s the lifeblood of our civilisation and the way we live, to trust somebody who won’t allow any audits is extremely risky. I personally don’t believe the numbers that are out there.

A difficult transition

The Australian Senate Committee [18] decided to remain agnostic towards a final peak oil date. But even the possibility of peak oil in the next few decades has them spooked. Chapter 3 states:

3.137 The committee cannot take sides with any particular suggested date for peak oil. However in the committee’s view the possibility of a peak of conventional oil production before 2030 should be a matter of concern. Exactly when it occurs (which is very uncertain) is not the important point. In view of the enormous changes that will be needed to move to a less oil dependent future, Australia should be planning for it now.

3.138 Most of the official publications mentioned in this report seem to regard the ‘long term’ as extending to 2030, and are silent about the future after that. The committee regards this as inadequate. Longer term planning is needed. Even the prospect of peak oil in the period 2030-2050 – well within the lifespan of today’s children – should be a concern. Hirsch suggests that mitigation measures to reduce oil dependence ‘will require an intense effort over decades…’

This inescapable conclusion is based on the time required to replace vast numbers of liquid fuel consuming vehicles and the time required to build a substantial number of substitute fuel production facilities… Initiating a mitigation crash program 20 years before peaking appears to offer the possibility of avoiding a world liquid fuels shortfall for the forecast period.

If the peak in global oil production is in fact this or next year, the implications for the world economy are profound, but beyond the scope of this article.

Footnotes

[1] Scientific American (September 2010) How much is Left? The Limits of Earth’s Resources.

http://www.scientificamerican.com/article.cfm?id=how-much-is-left

[2] ABC Science Catalyst (2005) The Real Oil Crisis (12 minutes)

http://www.abc.net.au/catalyst/stories/s1515141.htm

[3] ABC Science (2007) Crude – the incredible journey of oil

Part 2: Last hours of ancient sunlight (31 minutes)

http://www.abc.net.au/science/crude/resources/links.htm

[4] ABC Documentary 4 Corners (2006) Peak oil? (43 minutes)

http://www.abc.net.au/4corners/special_eds/20060710/

Transcript:

http://www.abc.net.au/4corners/content/2006/s1683060.htm

[5] Energy Bulletin — EnergyBulletin.net is a clearinghouse for information regarding the peak in global energy supply. We publish news, research and analysis concerning:

http://www.energybulletin.net/primer

[6] Scientific American (1998) THE END OF CHEAP OIL by Colin J. Campbell and Jean H. Laherrère,

http://www.hubbertpeak.com/_archive/ScientificAmerican199803/EndOfCheapOil.htm

[7] Association for Peak Oil and Gas

http://www.peakoil.net/about-aspo

[8] Range of published material

http://www.peakoil.net/publications

[9] Peer reviewed works from ASPO are generally behind paywalls

http://www.peakoil.net/publications/peer-reviewed-articles

However, Uppsala Universitet hosts a variety of their work for free.

http://www.tsl.uu.se/uhdsg/Publications.html

[10] Depletion – the missing demand element? by Chris Skrebowski — questions the IEA paradigms

http://www.energyinst.org.uk/index.cfm?PageID=952

[11] Minerals and Energy (2003) The Peak and Decline of World Oil and Gas Production by Kjell Aleklett and Colin J. Campbell

http://www.abc.net.au/4corners/content/2006/s1683060.htm

[12] University of Reading, Reading (2007) Assessing the date of the global oil peak: The need to use 2P reserves byR.W. Bentley, S.A. Mannan, S.J. Wheeler

http://eclipsenow.wordpress.com/why-now/bentley/

[13] World Energy Vol. 5 No.3 (2002) The future of the Oil and Gas Industry: Past Approaches, New Challenges by Harry J. Longwell, Exxon Mobil Corporation

http://www.aspo-australia.org.au/References/Exxon-WE-Longwell-dec-02.pdf

Longwell denies peak oil is imminent, but the data supplied by Exxon Mobil shows the 40 year trend in declining discoveries

[14] Heading For Peak: Skrebowski’s Oilfield Megaprojects Update (2005) Julian Darley interviews Chris Skrebowski

http://www.energybulletin.net/node/5266

[15] The oil supply tsunami alert (2005) by Kjell Aleklett

http://www.peakoil.net/Oil_tsunami.html

[16] Petroleum Review (2006) Prices holding steady, despite massive planned capacity additions: Petroleum Review regularly updates its listing of the upcoming so-called ‘megaprojects’. The aim of the listing is to attempt to answer the question as to whether sufficient oil is being developed to meet likely requirements going forward, writes Chris

Skrebowski.

[17] University of Uppsala, Sweden (2007) Giant Oil Fields – The Highway to Oil by Dr Fredrik Robelius

http://uu.diva-portal.org/smash/record.jsf?pid=diva2:169774

[18] Senate Rural and Regional Affairs and Transport Committee, Australia’s future oil supply and alternative transport fuels (2007), © Commonwealth of Australia 2007, ISBN 0 642 71726 5

http://www.aph.gov.au/senate/committee/rrat_ctte/completed_inquiries/2004-07/oil_supply/report/index.htm

[19] Journalist and author David Strahan (2007) IEA reviews reliance on USGS resource estimates

http://www.davidstrahan.com/blog/?p=69

[20] Guardian (November 2009) Key oil figures were distorted by US pressure, says whistleblower

http://www.guardian.co.uk/environment/2009/nov/09/peak-oil-international-energy-agency

[21] Download the entire Hirsch Report PDF from the wiki references and footnotes

http://en.wikipedia.org/wiki/Hirsch_report

.png)

En:

A good discussion of a problem that could disrupt the global economy even before the main effects of AGW begin to wreck it.

We will only see peak oil in the rear view mirror but it is likely that the peak was in 2005.We are currently on a plateau.There probably won’t be a cliff at the end of the plateau,just a decline,steady or otherwise.

But it is an academic discussion because all fossil fuels are a finite resource and will deplete sooner rather than later at the present rate of consumption.

Naturally,little or nothing is being done in Australia to prepare for this eventuality.The Growth At Any Cost mindset just can’t/won’t see the bleeding obvious.

dave:

nice job.

I’ve found ken deffeyes work on this question useful. also matt simmons graphs of declining major oil fields towards end of “twilight in the desert.”

I think it’s really important not to dismiss all this material written by long term geologists as junk.

To survive Peak Oil, electricity has to be CHEAP. We’ve got to get that into the heads of politicians and public.

Oil has two important characteristics, and it is easy to get confused.

The most immediate characteristic is as a source of energy. However once the price of oil gets above a certain level then we stop using oil just for energy. The first step in this process was when people stopped using oil for electric power generation, which happened 40 years ago. The next step, which is happening rapidly in North America, is that people stop using heating oil to heat their houses in winter. We are not running out of energy. Indeed it seems certain that we will get Nuclear Power working and producing cheap electricity well before there is any shortage of coal or natural gas.

The 2nd characteristic of oil is as an energy carrier. Liquid hydrocarbons are the ideal fuel for transport. And we have an enormous infrastructure using that. But the oil price has already disengaged from the price of energy. Natural gas is cheaper, electricity is cheaper if it doesn’t come from renewable sources.

So Peak Oil folk talk about oil’s declining EROEI: Energy Return on Energy Invested. We can see that EROEI is declining markedly. But this is now irrelevant. Oil is no longer being used mainly as an energy source. It is being used mainly as an energy transporter. The Peak Oil folk are quick to rubbish “The Hydrogen Economy”. Hydrogen is not an energy source at all, and it is easy to see that it is a very silly energy transporter. Time to wake up and rethink oil as energy transport, and stop worrying about its EROEI.

Once we stop worrying about its EROEI, we can see that it doesn’t matter if Canadian tar sands or very heavy oil requires a lot of energy to extract. We could even make oil out of thin air, using algae for example. The EROEI no longer matters.

This is not to say that we aren’t going to have a nasty decade or two. At the end the successful countries will be the ones that make Nuclear Power work. Certainly India and China agree on that point.

I think oil depletion is a more pressing problem than climate change but the evidence is even more subtle. There is some kind of interaction between high debt levels and the need to constantly inject more energy into the economy. Remove the energy variable and the economy stagnates. Thus the Europe and US economies are flat seemingly unable to get out of the doldrums. If that flows on to China and India those countries may import less minerals from Australia. We could be next. It may even be turn out in hindsight that a year like 2007 could be as good as it gets for the whole of the 21st century.

This is a two edged sword. If the oil price remains moderate we won’t prepare alternatives like electric transport in time for a sudden supply crunch. Since serious carbon taxes are unlikely coal will remain the cheapest form of energy. We will squander natural gas in power plants when it should be conserved as an oil replacement transport fuel. Note that many believe that global peak oil has already occurred and global peak coal (net energy not tonnage) could be as early as 2011.

Meanwhile global population increases and 2 bn poor aspire to middle class lifestyles … owning a car, a high protein diet, air conditioning, plane travel. Those who are or were until recently in the middle class see it all slipping away. Middle aged US stockbrokers go from McMansions to living in trailers with no prospect of ever going back. However even a frugal middle class will need adequate energy when oil, gas and coal are gone. Wind and solar won’t cut it.

Therefore we must urgently find reliable alternatives to fossil fuels. Views on whether this will moderate AGW seem to be divided. James Hansen says we must phase out coal immediately. Others (Aleklett, Rutledge et al) think it will happen anyway albeit with locked in warming. That doesn’t solve the problem of those who want to be middle class and those who want to stay middle class – they need a new form of scalable energy.

[…] Peak Oil Discussion « BraveNewClimate. […]

It’s a very hard concept to dismiss, but the sacred notion that a rising oil price will make new, unconventional reserves ‘economic’ to produce (along with ‘alternatives’) just doesn’t hold water. This conventional economic thinking holds for a specific range on the viability curve of a particular commodity but there comes a time when the ‘end user’ simply cannot afford to pay the price required for the ‘economic replacement’ of reserves! Simply seeing rising prices as a resolving mechanism that will make more available relies on ‘bubble thinking’ – imagining that the end users (you and I) can go on funding a rising price indefinitely. This of course is complete rubbish and applies to the notion of (necessarily expensive ) alternatives as well as to oil itself. There will be no cheap and/or plentiful transport fuel that will become available as the oil price rises. That’s one side of the ‘rock and a hard place’. The other that is ignored by ABARE and most other Government-sponsored analyses of the issue is the likely breakdown of the current oil market. We tend to forget that only around 16% of oil is produced and/or marketed by public companies (‘Big Oil’). The rest – over 80% – is produced by state-owned companies with the profits being part of the revenues of the countries concerned. In the final analysis the oil market has limited control over this enormous volume of oil. The countries concerned will have their own needs to contend with – both the needs of their own oil consumers as well as the imperative to ‘hold something in reserve’ for future generations. As it becomes obvious that conventional oil is truly a fiinite resource you can bet your last dollar that every energy minister in every producing country (especially those with burgeoning domestic demands) will be considering this question very closely. The clear implication is that there is no guarantee at all that future oil production will be available to the free market to the extent it is at present. Oil-available-to-market is not a given! As I’ve said, a rock and a hard place…

@ Barry, thanks again for this opportunity.

I’m wondering about this statement. Doesn’t point 2 empirically demonstrated their modelling to be flawed?

Sadly, I have come to agree. The science behind this argument appears too subtle, the vested interests too powerful, and the alternatives to oil too confused to deploy.

But we need to move now.

1. Electric transport needs scaling up now while we have some oil to do so! This is not a ‘normal’ market situation. It’s not about switching from Coke to Pepsi because Coke has become too expensive. In this rather dangerous situation, ‘Coke’ is sadly the means with which we can build out the ‘Pepsi’. As the doomers regularly point out, every wind turbine or nuclear power plant we’ve ever built was built with oil.

2. Peak oil is not the issue! The global depletion rate may in fact prove irrelevant. Who cares if the decline rate is 4% if the global MARKET for oil has in fact halved within a decade. Welcome to peak exports!

http://eclipsenow.wordpress.com/export-land-model/

If nations don’t sign up to an Oil Depletion Protocol oil sharing arrangement and producers start to hog it for themselves as demand from their own citizens overtakes their ability to pump oil in a post-peak world, then again: the MARKET for oil could dry up much faster than the global depletion rate. This is the complicated geopolitics of oil depletion, where producers who are currently sellers might become selfish ‘hoggers’ of oil.

I’m not arguing that there will not be enough oil to make the transition, but that the rationing we’ll experience will be that much more profound and the economic disruption will be that much worse. I’m not a ‘doomer’ (I don’t predict Mad Max) precisely because our society has so much ‘energy fat’ it could cut and still be a functioning civilisation, even if unemployment and interest rates and bankruptcies are like nothing the modern world has ever seen.

3. Relying on price could prove too volatile and destructive on world markets. We have legislated moving off CFC’s to save the ozone layer, off lead in our fuels for public health concerns; so why does price get to be the final arbiter in weaning off oil? Why can’t we install an “Oil Depletion Protocol” now, just to be safe? Why let high oil prices bankrupt our economies that will need to get the jump on depletion rates to build out the next big thing?

Imagine that “peak exports” has cut Australia’s ability to buy oil by about half. Imagine we have to ration oil to the most important liquid fuels sectors, such as agriculture and mining and construction and freight. 97% of our goods are moved by truck. Now I used to take some hope from the BZE ZCA plan that discussed how fast we could deploy fast rail etc around Australia. That has since been debunked as far too optimistic. EV’s might take the pressure off oil demand in private transport at a rate roughly equivalent to the global depletion rate. But this could prove irrelevant in the face of the Export Land Model. So who gets the oil rations? Will Qantas get it for tourism? How’s our tourism sector going to go? Exactly how bad will unemployment in this country be?

Basically, I’m concerned about the liquid fuels energy bottleneck we have to squeeze through. I expect our grandchildren to be living in a prosperous post-fossil fuels world. But the journey from here to there could be far harder than it has to be if governments don’t take action now.

It’s the precautionary principle writ large across our civilisation, both from a climate viewpoint, public health viewpoint, and depletion viewpoint. Now that’s an argument for leaving oil before oil first leaves us!

One last point: price is not a good guide to geology. We also HAVE TO remember the effects of the GFC on world demand for oil. The peak may well have come and gone, and we may be about to crash into 4,5, or even 6% declines… but the price effects of peak oil may have partially helped the GFC become that much worse… which in turn dropped demand for oil and lowered the price.

(Anyone arguing “Yay for the marketplace” from crashing oil prices just has to look at unemployment figures in America over the last few years, and historic debt levels in America, to judge whether or not the oil price crashing due to a recession is really a good thing).

I hate to agree with Podargus but I can’t get excited about people trying to predict when the “Peak” will occur. It is not unlike the folks who keep issuing hurricane predictions. Although they are wrong most of the time eventually they get lucky and crow “I told you so”

It makes little difference who gets the prediction right; “Que será, será”. As Prof. Hillis suggests, new energy sources will be developed in due time.

What we need to fear is the interference of governments in the market. Governments all around the world are pouring money into “Renewables” and “Green” technologies in ways that will appear laughable to our descendants.

It’s a very hard concept to dismiss, but the sacred notion that a rising oil price will make new, unconventional reserves ‘economic’ to produce (along with ‘alternatives’) just doesn’t hold water. This conventional economic thinking holds for a specific range on the viability curve of a particular commodity but there comes a time when the ‘end user’ simply cannot afford to pay the price required for the ‘economic replacement’ of reserves! Simply seeing rising prices as a resolving mechanism that will make more available relies on ‘bubble thinking’ – imagining that the end users (you and I) can go on funding a rising price indefinitely. This of course is complete rubbish and applies to the notion of (necessarily expensive ) alternatives as well as to oil itself. There will be no cheap and/or plentiful transport fuel that will become available as the oil price rises.

Nuclear powered synfuel production plants will save us. Provided we get around to building them, of course.

What I find interesting about Richard Hillis’ and, now, Barry Brook’s standpoints on “peak oil” is that both are highly respected scientists and yet both use economic arguments to counter the idea that energy supply will be limiting in our future. In the past, innovation has been used to substitute for limiting resources but the underlying factor that made the innovation and substitution possible was cheap and abundant energy. However, when the limiting resource is energy itself then the old paradigm no longer applies. High tech alternative energy devices do not exist in an economic vacuum – they require a complex technological society to support them and that society, in turn, requires a high level of energy consumption to fuel its rapid and complex interconnectivity.

When the price of a limiting element rises (e.g. a rare earth metal) we can apply abundant cheap energy to finding alternative technologies that no longer require it or we can expend large amounts of energy to extract it from ever more impure sources. However, when the price of energy rises (i.e. energy becomes limiting), unless one finds another source of abundant, concentrated energy that can be accessed RAPIDLY at a high energy profit ratio then substitution cannot occur. (Many arguments on possible energy futures fail to consider the scale of energy substitution that fossil fuel decline requires and the rate at which that scale must be attained.)

It is all very well to argue that Gen III or Gen IV nuclear reactors offer very high energy profit ratios but can they be scaled up rapidly enough to substitute for the predicted rate of drop-off of fossil fuel production? If they cannot do so then society will “de-complexify” faster than it can put the nuclear reactors in place. I would argue that the rapidly rising price of doing anything technological nowadays is the expression in economic terms of the fact that net energy in society is stalling or already in decline. (The example I have given to Dave a couple of times is that it took $100 million recently to build a 4 km tram line in Adelaide – so how much money do you think it will cost to roll out nukes in Australia and where will the money [energy] come from?)

Economics is not a science and the energy conservation laws in Nature will always give superior predictions than any economic theory. I can understand engineers falling under the spell of economic theory since so much of their training and work involves calculation of price, demand and profitability – it become part of their mental model of the world and integral to their thinking. However, when scientists use economic arguments to support ideas that (upon close inspection) can be seen to defy natural laws in which we have great confidence, then it worries me.

The two essays that sum up my position on our likely future energy path and the connection between energy and economics are:

“Energy is everything”

http://www.energybulletin.net/node/48731

and

The Oil-Economy Connection”

http://www.energybulletin.net/node/50827

The latter essay is particularly relevant to this discussion.

It is all very well to argue that Gen III or Gen IV nuclear reactors offer very high energy profit ratios but can they be scaled up rapidly enough to substitute for the predicted rate of drop-off of fossil fuel production?

Mr. Lardelli, do you have any solid figures on what portion of the energy used to construct an NPP is derived from oil? I would venture to guess that even if we do fall off the oil production slope in the near future, oil derived from coal could still be used to see us through to the implementation of a mature nuclear economy.

My apologies. It’s Dr. Lardelli. Sorry about that.

http://www.adelaide.edu.au/directory/michael.lardelli

Finrod,

Rising prices are not inevitable. New technology can cause large drops in energy prices. Rising prices cause people to get innovative. We are forced to consider energy sources that we ignore when the current energy sources are seen as relatively cheap.

There are some instructive examples to be found in history. For 200 years the dominant technology for lighting was whale oil. If Eclipsenow had lived in the 1840s he would have worried (correctly as it turned out) about “Peak Whale Oil”.

As the demand for whale oil soared and the supply of whales diminished prices rose to the point that alternatives such as lard, acetylene and camphene became competitive. Eventually, we had Spindletop; mineral oil soon became ten times cheaper than whale oil (thank you J.D. Rockefeller for saving the whales).

Today, much of our energy is coming from fossil fuels that will (someday) follow whale oil into the history books. We are being forced to look at all kinds of solutions and while prophesy is dangerous I predict that nuclear fission will become our primary energy source, with energy prices falling well below what they are today.

Hi Sam Powrie,

And that is the heart of the “Peak Exports” or “Export Land model” debate. You put it well!

Finrod:

Why not just take the electrons we’ve generated and charge electric cars? On a price / km basis, electricity is half the cost of oil and that is with today’s battery technologies!

Even better, why not design urban villages where we don’t require 60% of the trips we make now. Indeed, with some new urban designs, we could eliminate the vast majority of driving we do and just hire a car or van on those occasions we really need it.

@ Michael:

How do we double the energy efficiency of a V8? Chuck another passenger in. I agree that there is an energy crisis, but society has a lot of ‘energy fat’ we can cut and still maintain a complex industrial society. We can buy pushbikes with trailers, use internet websites to book carpooling arrangements, and use the internet in other ways to co-ordinate our CAS (Cascading Adaptive System) in ways not yet really appreciated.

I agree with you that governments should mandate the solutions now and not wait for the crisis, but I just think talk of society ‘decomplexifiying’ is a bit premature. We’ll have more localised economies in some sectors, but others that require scale and specialisation may still be international.

The cost to replace all our energy in Australia with nukes is tiny when compared to our GDP. The example of an expensive tram line is just silly when trolley-buses are 5 times cheaper (and probably 5 times faster!) to build.

Michael,

http://www.adelaide.edu.au/directory/michael.lardelli

That’s a nice body of work you’ve contributed to the peak oil discussion since I pretty much burnt out in 2007. (PTSD stuff with my sick son, etc).

While I disagree with the particular spectrum of ‘inevitability’ you’re on regarding our destiny, most of my mates and family still call me “doomer Dave” because I think we’re heading into a Greater Depression unlike anything the modern world has ever seen.

(However at this stage I’ll quietly point out that the Hoover Dam was built in the Great Depression, as a jobs creation program. Imagine our governments mandating all Australian car manufacturers to retool around EV’s, etc, the way America switched its economy around pretty much overnight in WW2.)

GC

Peak exports mate. If the oil sellers suddenly become oil buyers, who’s going to sell you the oil to build out the next big thing? So there’s an energy crunch coming, and I think Michael is asking all the right questions that you’re just assuming rather cliché answers to, and haven’t even begun to ask.

Unless something even BETTER turns up, I completely agree! But how rough is the journey there going to be? The world economy has already been weakened by 9/11, Katrina and other natural disasters, the GFC, and now the unparalleled debts we picked up in trying to solve the GFC. A friend had lunch with the CEO of Barclay’s bank, and bluntly said on sheer financial terms that America simply would not exist in 20 years! (The economy would crash so bad the place will be unrecognisable).

Add peak oil, stir in some climate catastrophes, and serve on a very cold plate.

@gallopingcamel:

That’s kind of what I was getting at. Did you not see that?

@eclipsenow:

I think we’ve had that discussion before, haven’t we? I’m no fan of our extensive use of FFs for goods transport (and I’m particularly annoyed at the intensive non-stop heavy vehicle traffic plaguing our interstate highways), but it will be some time before we see either a national electric rail network, or an electric semi-trailor. Or an electric combine harvester, bulldozer or dump-truck. Nor do I see the world’s urban design philosophy altering quickly enough to get us past this. Redesigning the urban environment is something I’m actually very much in favour of as a long-term sustainability policy, but we cannot use tomorrow’s capital to solve today’s problems. If it is true that we face an impending oil shortage, then we need to address it as a matter of urgency. Fixing the urban environment is a long-term goal.

Agreed!

But how urgent is it? If the world hit’s 4% decline, that sounds fairly imaginable. What Sam highlighted above is the way nationalised oil production could easily decide, “Sorry world market for oil, but our folks need this right now”.

http://en.wikipedia.org/wiki/Export_land_model

But how urgent is it? If the world hit’s 4% decline, that sounds fairly imaginable. What Sam highlighted above is the way nationalised oil production could easily decide, “Sorry world market for oil, but our folks need this right now”.

When it’s all said and done, I doubt that the major oil producers have as much freedom of action in this regard as you imagine. But whether we need to be concerned about a precipitous decline in oil production or not, this does not affect the fact that less energy and other forms of wealth will need to be expended in building nuclear-powered synfuel plants to provide for transport and heavy machinery needs than to largely rebuild the bulk of the world’s modern cities.

Dear Dave and Finrod, Read the two essays. The answers to your questions/comments are all in there. The latest Hubbert analysis of coal production also indicates that coal may peak next year (see Paztek and Croft: http://www.utexas.edu/news/2010/07/26/engineering_patzek_coal/ ) and the USA is already beyond peak net energy from coal (see http://www.energybulletin.net/52810 ). As energy declines my prediction is that the remainder will be squandered on useless attempts at “economic stimulus” and will eventually be focussed into food production that currently consumes 30% of world fossil fuel energy (http://aleklett.wordpress.com/2010/05/19/agriculture-as-provider-of-both-food-and-fuel-2/). As economies localise and “just in time” logistics disappear then high tech manufacturing will grind to a halt. (The production of a “simple” photovoltaic cell requires thousands of materials and processes that can only be performed by a functioning network of mining and manufacturing.) A rollout of nuclear energy expansion to the scale required would require decades and, in that time, societies and economies will be thrown into chaos by the decline in fossil fuels, increasing population (demand for food, goods and services), climate change (esp. effects on food production) and decreasing other resources such as phosphate (affecting food production once again). The best strategy is to get ahead of the curve by relocalising food production, collecting low energy technologies for use after the decline and concentrating on preservation of the knowledge that we obtained during our century-long, high energy “growth party”.

@Michael Lardelli:

So your advice is to abandon any hope of a rational engineered solution and all become peasants. No sale.

Finrod, Read the two essays. The answers to your questions/comments are all in there.

I didn’t see an answer to my question about what portion of the energy required to construct an NPP is covered by oil in either essay. If I’ve missed it, can you please detail where to find it? Actual numbers too, rather than general statements.

I’m more interested in generalised statistics. EG: If we halved private oil consumption (normal suburban driving) through car-pooling etc, how much would that free up the annual depletion rate?

EG: Under point 3 of my “Dark Mountain Bulverises” article, I said:

http://eclipsenow.wordpress.com/2010/08/12/dark-mountain-bulverises/

I was just struggling to say that as pressure in one sector decreases, it frees up fuel for the more important sectors as we deal with those (whether biochar gas, algae, nuke-synfuel, or whatever).

Hi Finrod – what you needed to understand from the second essay is that it is not possible to draw a line around the energy required for a NPP. NPPs do not exist independent of a functioning technological society and if you do not have that you cannot have your NPP rollout.

Like eclipse you are sounding a little fundamentalist here as if the future is “peasants” (aka a “doomer’s” existence) or “rational engineered solutions” (by which you really mean a “business as usual” lifestyle only with the energy required supplied by NPPs rather than fossil fuels). The alternative path is to stop economic and population growth, retain our knowledge and valuable technologies (such as vaccines, contraceptives, antibiotics, bicycles, water pumps etc.) and put our efforts into developing something that is truly sustainable rather than squandering our remaining energy on technologies on growthist dreams that, ultimately, cannot be sustained in a finite world. (Understand too that it is not only energy limits that we are up against – we are facing converging multiple resource declines and so solutions focussed only on energy cannot work.)

You say “no sale” but I say that nature does not care what you think or what you want. Those that believe they can defy energy laws (i.e. as reflected in the functioning of our human ecology/economy) will be punished severely.

Hi Finrod – what you needed to understand from the second essay is that it is not possible to draw a line around the energy required for a NPP. NPPs do not exist independent of a functioning technological society and if you do not have that you cannot have your NPP rollout.

Michael, now you’re just covering yourself with a verbal smokescreen. If you don’t know the answer, just say so. These details are important for giving meaning to these discussions. If you haven’t bothered quantifying the amounts of oil needed for certain key technologies and manufacturing techniques, you’re just arm-waving. You also run the risk of not recognising paths and strategies which may help overcome peak-oil issues.

Like eclipse you are sounding a little fundamentalist here as if the future is “peasants” (aka a “doomer’s” existence) or “rational engineered solutions” (by which you really mean a “business as usual” lifestyle only with the energy required supplied by NPPs rather than fossil fuels). The alternative path is to stop economic and population growth, retain our knowledge and valuable technologies (such as vaccines, contraceptives, antibiotics, bicycles, water pumps etc.) and put our efforts into developing something that is truly sustainable rather than squandering our remaining energy on technologies on growthist dreams that, ultimately, cannot be sustained in a finite world. (Understand too that it is not only energy limits that we are up against – we are facing converging multiple resource declines and so solutions focussed only on energy cannot work.)

I apologise if you are not of the ‘doomer’ mindset, but if it seems I’ve judged you to be so, it’s hardly my fault. Your prescription would result in billions of deaths by starvation, and you’re talking down the nuclear solution necessary to avoid this. You might not call yourself a doomer, but your recommended policy is in accord with doomer ideology, and would indeed act in the manner of a self-fulfilling prophecy if acted on. Of course, your contention that we are up against limits other than energy is only true id energy is expensive, or in short supply. Nuclear power need be neither, and once we have that virtually unlimited energy source powering the world, we can go to dull recycling, or to the extraction of low-grade reserves of stuff like phosphates from sources which would not be considered economical today.

You say “no sale” but I say that nature does not care what you think or what you want. Those that believe they can defy energy laws (i.e. as reflected in the functioning of our human ecology/economy) will be punished severely.

Very true, but I suspect that I shall have better cause for comfort from the literal meaning of your statement than yourself as time wears on.

We will most likely need hydrogenated synfuels for high power-to-weight applications like aircraft. I think that means fewer people will fly hence the case for electric high speed rail. Reading The Oil Drum about the decline of net energy measured as (energy out)/(energy in) this ratio had a value of about 30 for petroleum fuels back around 1950. These days for fuel from Canadian tar sands the ratio is 3 to 5 and for corn ethanol 0. 8 to 1.25 . Thus if an energy return of 1 is breakeven after tractors, fertilisers and distilling there is no real point in making corn ethanol fuel.

Windpower enthusiasts point to energy return ratios of 20-30. Great but what happens when there is no gas backup? If I recall nuclear is about 100. The case has been made that primary energy sources need an averaged return of at least 10 that will last as long as the human race. Otherwise it’s back to the Neolithic.

Some might say how can this be when oil based fuels and chemicals are moderately priced. Either wait a few years or ask why the world economy remains sluggish.

I think the world needs a little bit more economic growth, in the 3rd world at least. I think the only way population growth is naturally curbed without draconian 1-child policies is by meeting all human needs. (Which creates the demographic transition. Note: I did not say “all human wants”, and I agree with you that there is probably a much larger societal discussion that needs to happen about how we can satisfy wants in different ways).

So I find your assertion here…

…to be a false dichotomy. Abundant cheap electricity is the only way we’re going to get through peak oil without dieoff.

Your article “Energy is everything” neatly dodges that we have enough nuclear waste to run the world for 500 years in GenIV reactors. It also makes this claim:

http://www.energybulletin.net/node/48731

Maybe, but if the economy is crashing anyway, won’t governments be seen as stimulating work by a massive build out of nuclear power? In other words, this next statement is a bit rich.

You only have to go back to the Greater Depression and see what they accomplished in employment on National Parks and building the Hoover Dam to see that sometimes massive government intervention is not a choice of “building nukes OR jobs and lifestyle” but both.

I’m sorry, but this is the ultimate case of special pleading! It’s almost like your dredging the bottom of the barrel to find excuses for why governments won’t prioritise when peak oil forces them to! I can almost imagine such scenarios, but really it sounds pretty thin.

Overall, I agree with the questions you are asking in your 2 articles. If anyone hasn’t read them, please grab a coffee. Read them. Slowly.

http://www.energybulletin.net/node/48731

http://www.energybulletin.net/node/50827

But if anything, Michael has just made the case for GenIV nukes that much stronger and more urgent.

Lack of oil and coal will not save the climate…

http://translate.google.com/translate?js=y&prev=_t&hl=sv&ie=UTF-8&layout=2&eotf=1&u=http%3A%2F%2Fuppsalainitiativet.blogspot.com%2F2010%2F03%2Fbrist-pa-olja-och-kol-raddar-inte.html&sl=sv&tl=en

I have said my bit and people can either take the message to heart or not. It makes little difference in the end. I am not interested in saving the entire world when it seems obvious to me that it cannot be saved. Rather, I concentrate on my little patch. Here in Australia is where we might have a chance at some sort of survival if we stop population growth, localise our agriculture and adopt “low tech” solutions. World energy growth appears to be over so world economic growth is over – although it might continue for a while in some areas while other areas decline. If I could have my wishes fulfilled I would like the world to continue to develop and “grow” but that is not determined by what I, or anyone else, wants. It is determined by the volume of energy throughput. Humankind is about to relearn that it exists at nature’s sufferance and is not nature’s master.

I have said my bit and people can either take the message to heart or not.

Good. Take your counsel of despair elsewhere, or better still, cease bothering people with it at all. Some of us still recognise value in humanity and are unwilling to surrender the struggle unfought, or casually accept the ugly death of billions of people with your ‘I’m all right Jack’ detachment.

For the bearer of such dire tidings, you are curiously averse to providing actual numbers to back up your case. Why should anyone accept such a miserable prognosis on your math-free say-so?

Here’s some big picture reasoning on the magnitude of the fossil replacement problem. If I recall the David Mackay book said that Brits used 125 kwh of energy a day, call it 6kw continuous. Perhaps the Brits drive less than Aussies but they need more more winter heating. Aussies will also need desalination and thermal comfort in heatwaves approaching 50C. Anyway 6kw X 22m people = 132 GW continuous power. That is for overall fossil fuel replacement; oil free transport, no gas for ammonia or process heat and no coal for electrical generation or cement manufacture.

I don’t think 10% cuts savings here and there aided by smart meters and pink batts in the ceiling will get close to replacing this demand. The system will disintegrate without some essential energy flows. We could get rid of SUVs but must keep ambulances. The world is coping so far because oil is just coming off a plateau. I think the depth of the problem will show itself within just a few years.

Well, this is an interesting discussion.

My only problem with it is that it is filled with far too many IFs.

IF we roll out nuclear now… Don’t make me laugh – it takes twenty years to go through the rigmarole and commission a nuclear plant. PLUS nobody anywhere in the world has sorted out waste storage and decommissioning costs.

IF we turn to a hydrogen economy. IF we suddenly, magically get our food delivered to the local shop – be it a little village shop like here or some great hypermarket – by electric powered semi-trailers.

And on and on.

I am not a geologist or economist or any such but I have been quietly following this topic for years. The really big problem as I see it is that informed opinion seems to be converging on Peak Oil arriving somewhen round about 2014-2015.

NOBODY in power – i.e. governments – is doing ANYTHING about it. In the mean time we have the likes of BP scouring the most inhospitable environments on earth trying to access mere puddles of hydrocarbons. The Arctic – don’t make me laugh. Eighty billion barrels. Do the maths! Eighty five MILLION barrels a day!

Remember the Hirsch report? Twenty years to mitigate Peak Oil without substantial world wide effects. Ten years and we see considerable economic and social impacts. WAKE UP EVERYBODY – we are looking at four or five years. Those nuke plants will NEVER get built. We might scrape by on ten percent of the energy we enjoy now with whatever renewables we can get in place by then.

In the meantime Business as Usual will prevail. Governments will, by necessity continue to ignore it – they are all in the pockets of big money anyway, and to try to do anything about it would make them not re-electable.

Me, a doomer? Yep! Happily watching from a corner of the world which I found purely by chance and where I think at least Life as Usual has as good a chance of continuing as anywhere else in the world.

Michael Lardelli,

If you are right the human race will be punished for its vigorous, technology based growth. The punishment exacted could be as severe as extinction.

While the nattering nabobs of negativity may eventually be able to congratulate themselves (posthumously) for being right, I refuse to plan for failure and defeat.

My vision is a future with far more abundant and cheaper energy than today. When the fossil fuels run out we will have advanced fission reactors. When the Thorium runs out we will have fusion power.

As Eclipsenow says there could be something completely unforeseen, comparable to cold fusion. Anyone for anti-matter mining?

If society did collapse and millions / billions died, I imagine all sorts of scenarios where it would bounce back again relatively quickly.

We’ve tasted the lightning, and we LIKE IT!

It might start off much like these “Otherpower” hippies up off the grid in the mountainous USA, living off super-energy efficiency and local renewables. But soon society would want something more. It would only take a few generations before villages were coalescing to pay people to dig deep into the old pre-collapse libraries and learn about nuclear power again.

Check out the sheer ‘romance’ of building your own power supply (in on a windy enough mountain top where most of us DON’T live) out of local timber, a few car parts, some magnets and copper wire. This is Mad Max living at its best. 😉

http://tinyurl.com/2ctogdm

The whole problem with ‘I think…’ is that it’s simply opinion, dream or at best, hope. None of these constitute a strategy or plan. Galloping Camel’s last sentence says it all for me. Thousands of scientists, economists, geologists and technicians have been studying resource depletion, and specifically that our ff energy resources for some 40 years now. The understanding of the challenge has been increasingly refined yet there is still no productive solution. As a result, those who dream of a future for humankind that simply reproduces a civilization built on oil can do nothing but dream. There is no such thing as ‘cold fusion’ so there is no point in using it as some kind of benchmark. There is no such thing as ‘antimatter minding’ either. Even if you are joking such fantasies remain just that. The simple fact of the matter is that human population growth has tracked the growth in availability and use of fossil fuels almost exactly. As ff availability and use declines, we must naturally ask if there is some natural law that says population growth can continue unabated. We find that there is no such law! We must naturally ask if there is some alternative to oil that will allow us to forge ever onward. There are of course many alternatives. The problem is that none will accomplish the ‘work’ (in the Newtonian sense) that oil currently accomplishes for us. In this sense, while there will always appear to be alternatives at an individual level, there is no alternative to oil that can do what it currently does for humanity. Including the work involved in forging a bright and expanding future. So we need a different idea to sustain us into the future. That is all that Michael Lardelli is saying as far as I can see. He is simply pointing out that most of the current ideas that civilization holds gear of the future are inevitably corrupted by unfounded promise and hope. If humanity as a whole truly wants a way forward then we need a very different idea. Personally I don’ think such a collective notion will find nuclear solutions useful – they are too inflexible, too shortlived and far, far too unwieldy to create and manage. But that’s just me putting 2 and 2 together…

Sam Powrie,

Adelaide.

Why do you feel this Sam? GenIII nukes are ready to roll out today, and there are various plans for GenIV nukes that are still being commercialised. Russia and China are building a few GenIV reactors now, but with all sorts of ‘first of a kind’ costs associated with them. (How expensive is a car? Depends on the car!)

So once the GenIV nuke is adopted on a factory line, and is mass-produced, costs will plummet and we’ll see one of the fastest roll outs of clean power in history.

All governments have to do is mandate various fast-charge EV’s or even Better Place battery-swaps, and natural attrition of old cars being replaced by newer cars could ‘pretty much’ keep up with the worldwide depletion rate (IF we can get nations to sign up to the ODP and not be adversely impacted by ‘peak exports’).

Now, agriculture and airlines may even require some Coal-to-liquids until we get nuke synfuels perfected, but nuke-synfuels do appear on the way.

http://www.lanl.gov/news/index.php/fuseaction/home.story/story_id/12554

We can rezone our cities and create FAR more energy efficient cities over the next generation.

http://eclipsenow.wordpress.com/rezone/

We can use plasma converters to rip apart our municipal waste and get synfuel from the hydrocarbons and plastics, and sand/metals or even rock-wool (safe asbestos replacement) from the other solids in our garbage. Even council ‘green waste’ could go into this for more synfuel, although I’d hope rural areas pushed their green waste through into biochar cookers to improve the soils that feed us.

All sorts of new material sciences and green chemistry are being developed to gradually reduce our need for mining. I know peak oil doomers that have allowed that ‘peak metals’ is not really a problem if we just assuming enough energy to run various low-grade ore mining schemes and metal recycling schemes.

Basically, Industrialisation 2.0 is practically ready to roll out. Our grandchildren may even live in a world that hardly requires mining. Or if they did, they’d know how to restore ecosystems after mining the useful ores out of an area. They’ll have answers to ecosystem and biological questions we don’t even know to ask yet.

By then, assuming these technologies are rolled out fast enough, we’ll also have a stable population, and maybe even have developed stable state economies. Whole new systems of economic thought will be developed over the coming years. I have a mate in economics who thinks we already have the tools for a stable state economy. Look at Japan, who’s population hasn’t really grown and economy hasn’t really boomed for a decade now. It hasn’t collapsed into the dark ages.

So peak oil is a real risk. Climate change is a risk. War is a risk. Anything could happen. But if I get to have a say on what we’ll do, then we’ll roll out the GenIII nukes, put some serious R&D into commercialising the GenIV technologies we already know work, and we’ll see our cities shrink in area but grow in quality and beauty, we’ll see ecosystems restored, we’ll see farmlands rebuilt at the chemical and biological level by adding biochar, we’ll see public health and societal community systems restored through good urban planning and public transport, and we’ll see our children growing up in healthier, cleaner, trendier cities. Sounds good to me!

Personally I don’ think such a collective notion will find nuclear solutions useful – they are too inflexible, too shortlived and far, far too unwieldy to create and manage.

This assertion runs contrary to the general thrust of two years discussion and debate on this site, so if you have some new, credible information on the matter, best you put it to us. After all, you’re basically saying that the case against nuclear power is so persuasive that we shouldn’t waste our time trying to save all those billions of lives which will inevitably be lost in your idea of a post peak oil world. So, rather than leave yourself open to the charge that you have casually accepted a future embracing genocide on an unprecedented scale when it isn’t necessary, the moral burden is on you to convince others that nuclear power should not be pursued. It will take more than your casual, unsupported say-so to do this. Back to you.

Steve, 20 years to build? Are you serious? You know that in an emergency legislation can get passed to fast-track things. You should also read up on nuclear power a bit, because you sound like me 8 months ago and it’s a bit embarrassing to be reminded of how ignorant I was.

Nuclear waste a problem? Far out man! Get with the times. I was so embarrassed when I found out the reality that I got my wife to design this poster!

http://eclipsenow.wordpress.com/nuclear-posters/

In the first of Michael Lardelli’s essays that he linked to, the ‘net energy cliff’ graph which is pretty fundamental to the whole hypothesis, plots nuclear as having ERoEI of only 5.

This strikes me as incredible. As John Newlands said above on the subject of energy return ratios…”if I recall nuclear is about 100″.

What gives? Has this issue been covered quantitatively on BNC somewhere?

There is no mention made about reducing our demand for energy by increasing our efficiency in using it.

The nuclear industry have been promising great things for years but these waste heat stations (power stations) keep getting to be more expensive and the size of their government subsidies keeps increasing, they do not even pay for their own insurance in case of a nuclear accident.

The manufacture of Electric vehicles need quite a large amount of fossil fuels.

I see very little mention of wind power, solar energy, wave power and geothermal power as a low polluting and sustainable scource of energy for the future.

We have to realise that we live on a planet with finite resources and that we must increase our use of renewable resources in place of depleting the finite resources.

Mark, it’s been covered here: Estimating EROEI from LCA http://bravenewclimate.com/2010/03/08/tcase8/ People tend to cite figures that best suit their argument.

Barry, what do you make of the failure of the USGS to predict discovery trends over the last decade?

Think, I’m all for energy efficiency. I think there is a really strong case for more beautiful ‘walkable’ cities. The Senate inquiry into peak oil basically recommended increasing public transport and New Urbanism / Transit Orientated Developments. Please see the first few youtube clips on my blog page on this topic for more.

http://eclipsenow.wordpress.com/rezone/

But we also need to guarantee our energy supply with reliable baseload power DESPITE the weather, season, or time of day or night. As peak oil hits, we’re going to need far more electricity, pure and simple.

One comment on renewables: How many times have you read that just 50km by 50km of solar PV would provide all Australia’s energy?

Do they mention what to do at NIGHT in these scenarios? 😉 Until storing electricity comes down 1000 times in cost and maybe increases 100 fold in power storage, renewables just can’t cut it. Check the tab at the top of this page, “Renewable limits” for more.

That the USGS were over-optimistic in their predictions, but equally, that the supply-demand gap hasn’t widened sufficiently to make it worth seriously exploiting unconventional sources on a large scale – yet. Remember, I’m not denying that peak oil will happen, nor that energy agencies get things wrong – they clearly do. I’m simply saying that they’ve made the best predictions so far, and that it is very unlikely that there will be a cliff after the peak.

Hi Barry,

what about this?

Oops, code didn’t work. Try this?

Blaarrgh!

http://en.wikipedia.org/wiki/Export_Land_Model

EN, one problem I see immediately with the Export Land Model is that it doesn’t follow through its own consequences. Especially when (as here) you’re using it to argue for precipitous declines in global oil availability. That would lead to equally precipitous price rises, and so to reduced consumption in Export Land as well as everywhere else. Those sorts of negative feedbacks need to be accounted for properly, even in cases where domestic consumption is subsidised (as the cost of those subsidies will drag down the whole economy).

In the same vein, why do governments have to mandate “various fast-charge EV’s or even Better Place battery-swaps”? If oil prices do anything like what even the moderate PO scenarios propose, those technologies will be adopted willy-nilly, without any help from governments.

As someone once said, the best cure for high oil prices is…high oil prices. This is fundamentally why, as Barry says, it is very unlikely that there will be a cliff after the peak.

Spoken like a true economist! But this is energy we are talking about, not Coke or Pepsi. It takes oil to wean off oil. Oil is so fundamental to every other product in our society, that we are NOT just talking about the price of oil going up here. It’s food, it’s freight, it’s plastic, it’s fertiliser, it’s everything!

The Hirsch report indicates that energy economics dictates that we need a 20 year program of weaning off oil to adjust, or a 10 year ‘big government’ crash mitigation to have any hope of a soft landing.

$300 a barrel oil is not the solution… it’s high unemployment, bankruptcy, rationing, a Greater Depression, bankrupt airlines and bankrupt tourism. It’s international competition for oil, bidding wars, maybe even war! It’s 3rd world countries hitting Mad Max because somehow even they became hooked on oil. It’s massive societal disruption.

In short, we’ve got to leave oil before it leaves us. Or the following trailers indicates where we are heading.

See Kjell Aleklett of ASPO and Dr Robelius.

I put my faith in speculators. If oil is going to run short in ten or twenty years then speculators will be:-

i) pouring their money into researching new energy sources.

ii) buying oil futures to cash in on the coming crunch. Of course in so doing they will drive up the current oil price and hasten the technological shift.

If you’re worried about peak oil and confident in your predictions then go buy oil futures on mass and persuade other people to do the same. In short put your money where your mouth is, make a killing and help save us in the process. You could be a rich hero if your predictions are right.

Eclipse – you’re assuming that a high oil price would only come from a current shortage. A future shortage can cause a rise in the current price as people stock oil for the future. Further more a high future price can cause a current shortage for the same reason which is what happened when OPEC saw the US leave the gold standard and expected inflation.

Terje,

Sorry, but I don’t think the oil market runs that way. They’re trading it as if there’s 20 years left before peak, which is what the USGS and others seem to be forecasting. Everyone just assumes that it is lack of investment… that we’ll be pumping 95 or 100 or 130 million barrels a day in 20 years.

They’re studying the oil ‘moving into and off the shelves’ rather than what’s happening under the ground.

The marketplace doesn’t know. It just doesn’t.

Eclipse, though you didn’t say so outright, it seems to me your $300/bbl scenario is predicated on an sudden step change. I’ve had a look at Hirsch et al, and it’s not at all clear to me how and where they make the case that the post-peak transition will necessarily be abrupt.

Moreover, Hirsch et al themselves list a number of ‘upsides’ that “might ease the problem of world oil peaking”. Since their report was written over five years ago, subsequent events have put ticks in several of those boxes:

Entirely new oil fields containing over a billion barrels have been identified off Brazil and in the East African Rift, both eminently extractable.

When Hirsch et al was published in early 2005, the world oil price was around $50/bbl, and that was considered high at the time. Since then it’s averaged $72/bbl, and it’s been steady at or a little above this level for the last year. Not up to ‘a decade or more’ yet, but we’re well down this path.

There have been moves in this direction.

Tick, the GFC did indeed knock a significant hole in consumption, and population growth continues to slow.

I believe this has indeed eventuated.

See second point above; we have indeed seen significant tooling up of manufacturing capacity to produce hybrids and electric vehicles.

Maybe not any ‘breakthroughs’, but steady progress continues to be made with hybrid and EV technology and affordability.

Evidence please? Megaprojects to Aleklett and Robelius is anything over 500 million barrels or about 100 thousand barrels a day. What is the peak rate of extraction from a billion barrel field? 200 thousand a day? 300 thousand a day? Demand from India and China is expected to rise by about 1 million barrels a day each year after this year. Basically, when exponential growth in demand keeps rolling along, you can expect the world to need a new Saudi Arabia every 3 or 4 years to account for growth in demand and offset depletion. It just isn’t going to happen. Moves in fuel efficiency are important, but what we really need is moves towards oil substitution, especially from America who are close to being bankrupt from financial matters alone.

Agreed, but when are we going to get serious about deployment? Having the technology on a shelf where various companies are allowed to take a few demonstration models out for a play now and then isn’t the same as independence from an increasingly fragile oil market. My argument is that the kind of collapse or decline of civilisation scenarios Michael present above are not inevitable. But when I encounter denial of the seriousness and imminence of peak oil, I pretty much think a Greater Depression is inevitable, as action will only really occur after people see the sh*t hit the fan. And then it will be too late. You thought the GFC sucked? Just wait for the next decade! But if we somehow muddle through the next few decades without getting into real oil wars, then maybe our grandchildren will see a brighter future. I do worry for my kid’s generation though. It’s going to be horrible to watch.

There are few reassuring signs that the big end of town has any answer to Peak Oil. They do say drilling in the Arctic will be easier when it is free of ice. Note at the onset of the GFC (which industry failed to see coming) in July 2008 the price of oil was $147 a barrel, double what it is now. Yet economic fundamentals suggest strong demand in the face of declining supply should see steady price increases. Perhaps the speculators don’t want to frighten the horses this time.

The once mighty General Motors company is putting all its faith in plug-in hybrid cars charged from the grid. The problem is their own market research suggests customers are unenthusiastic. On the other hand post private cars the alternative may be bringing a trolley load of groceries home on the bus. That’s if food is still affordable.

What if oil goes to $200 a barrel and stays there? Battling out of town commuters won’t earn enough to get to work. Farmers won’t be able to run tractors or buy fertiliser. Tourist resorts will be deserted. It is hard to see how the tiny steps we are taking to reduce oil dependence can achieve the huge adjustments needed. Even with cheap oil Europe and the US seem unable to emerge from the economic doldrums. What happens when there is 20% less oil, 50% ?

All very good questions John, and I wish I had comforting answers. Anything is possible. I hope we can bring on the EV’s and trolley-buses and New Urbanism and TOD’s and biochar biofarming and nukes all in time as the depletion accumulates… but why oh why is action on this so painfully slow?