Guest Post by Peter Lang. Peter is a retired geologist and engineer with 40 years experience on a wide range of energy projects throughout the world, including managing energy R&D and providing policy advice for government and opposition. His experience includes: coal, oil, gas, hydro, geothermal, nuclear power plants, nuclear waste disposal, and a wide range of energy end use management projects.

A 10-page printable PDF version of this post can be downloaded here.

An Excel worksheet showing the calculations (allowing you to change inputs/assumptions) is also available.

Introduction

What is the cost of carbon dioxide (CO2) emissions abatement with the various electricity generation technologies being considered for Australia?

The abatement cost of a technology depends on many factors such as the engineering characteristics of the electricity grid to which the new technology will be connected, the geographic location and many others. One important factor often not mentioned is the reference case against which the abatement cost is calculated. The abatement cost for a new technology is only meaningful when compared with another new technology or with an existing generator it would ‘displace’; e.g. nuclear compared with a new coal power station or nuclear compared with an existing power station.

The Electric Power Research Institute (EPRI, 2010) report http://www.ret.gov.au/energy/Documents/AEGTC%202010.pdf for the Australian Department of Resources, Energy and Tourism provides data that allows CO2 abatement costs to be estimated for a range of new technologies. Unfortunately, the report is complex and opaque in parts.

The purpose of this paper is twofold:

- to summarise in tabular form the relevant information from the EPRI report so others can access it easily and produce levelised cost of electricity (LCOE) figures under differing assumptions, particularly using the NREL LCOE calculator http://www.nrel.gov/analysis/tech_lcoe.html .

- to calculate and compare the CO2 abatement costs for a range of new technologies for each of three ‘displaced’ technologies.

This paper does not attempt to calculate the effects of carbon price on the LCOE or CO2 abatement costs, because:

This paper does not attempt to calculate the effects of carbon price on the LCOE or CO2 abatement costs, because:

1) the EPRI report does not include the effects of carbon price — nor feed in tariffs, renewable energy certificates and other subsidies — so incorporating the effect of CO2 pricing, and other incentives and disincentives in the analysis would require many additional assumptions, and

2) the purpose of this paper is to show the abatement costs for the various technologies so options can be compared and so the cost of incentives and disincentives (including carbon pricing), which would be needed to make each technology viable, can be made visible.

Methodology

The CO2 abatement cost is calculated for seven new electricity generation technologies, selected from the EPRI report. The seven new technologies are:

- Coal (black, without CCS).

- Coal (black, with CCS)

- Nuclear

- CCGT (Combined Cycle Gas Turbine)

- OCGT (Open Cycle Gas Turbine)

- Wind (wind class 5, 100 x 2 MW)

- Solar thermal (Central Receiver, 6h storage, DNI = 6)

The abatement cost for each is calculated by comparison with each of three ‘displaced’ technologies:

- Hazelwood, brown coal power station, Victoria (1,600 MW, commissioned 1964 to 1971)

- Liddell (see photo above), black coal power station, NSW (2,000 MW, commissioned 1971 to 1973)

- A new black coal plant, withoutCCS; (this is same as #1 in the list of new technologies).

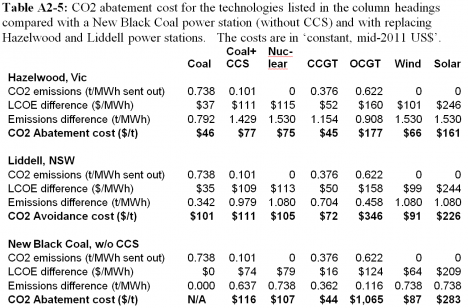

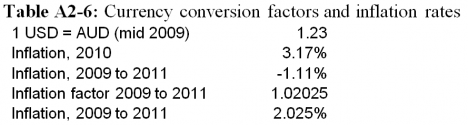

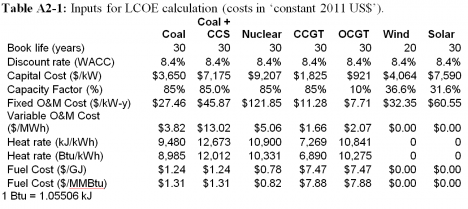

Most input data are taken from EPRI (2010) http://www.ret.gov.au/energy/Documents/AEGTC%202010.pdf ; these are summarised in Appendix 1. To bring the figures up to date and to aid in international comparisons, costs presented in Table 1 have been converted from 2009 A$ to 2011 US$; these are in Appendix 2. Details of the costings, including the exchange rates and inflation rates used, are included. The calculation steps and results are presented.

CO2 Abatement Cost is the difference in LCOE divided by the difference in CO2 emission intensity (EI):

CO2 abatement Cost = (LCOEnew – LCOEdisplaced) / (EIdisplaced – EInew)

The data needed for calculating LCOE for each technology, using the NREL simplified LCOE calculator http://www.nrel.gov/analysis/tech_lcoe.html, are provided in the Appendices.

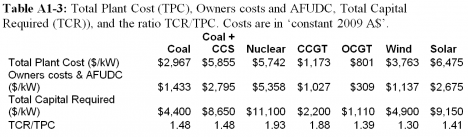

The capital cost is one of the inputs needed for the LCOE calculation. The capital cost figure needed is the Total Capital Required (TCR). But theTCRfigure is not given in the EPRI report. As such, the method of estimating it, including the inputs and intermediate calculation results, are presented in Appendix 1.

The CO2 emissions intensity (EI) presented in the EPRI report includes only the emissions from burning the fuel in the generator. Fugitive emissions are not included. Nor do the emissions intensities include the higher emissions intensities produced when load-following; e.g. when cycling power up and down to back-up for intermittent renewable energy generators.

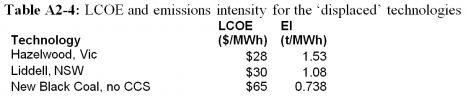

The emissions intensities (EI) for Liddell and Hazelwood power stations are 1.08 t/MWh and 1.53 t/MWh (sent out) respectively (ACIL-Tasman (2009), Table 18 http://www.aemo.com.au/planning/419-0035.pdf ). These EIs include fugitive emissions (whereas the EPRI EIs do not). This causes an error in the calculated abatement costs. In the ACIL Tasman report, fugitive emissions comprise 10% to 27% of EI for gas, 2% to 9% for black coal and 0.3% for brown coal.

The LCOE for Liddell and Hazelwood are ‘Commercial in Confidence’, so I’ve used $30 and $28 respectively, which are figures I’ve seen stated for the ‘equivalent LCOE’ for the remaining plant life.

Results

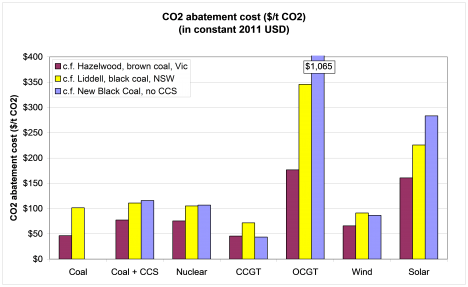

The CO2 abatement costs are summarised in Figure 1.

Figure 1: CO2 abatement cost for seven selected new technologies (named on the horizontal axis) compared with each of three ‘displaced’ technologies (named in the legend). Abatement costs are in US$/tonne CO2 (constant, 2011US$).

Figure 1: CO2 abatement cost for seven selected new technologies (named on the horizontal axis) compared with each of three ‘displaced’ technologies (named in the legend). Abatement costs are in US$/tonne CO2 (constant, 2011US$).

The inputs and intermediate calculation results are in Appendix 1 (in 2009 A$) and Appendix 2 (in 2011 US$). The data in Figure 1 is from Table A2-5.

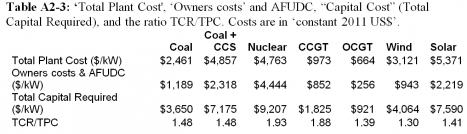

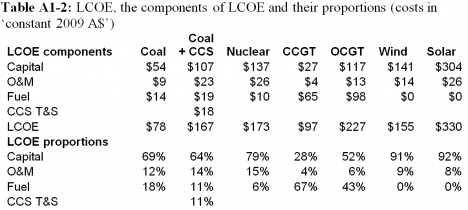

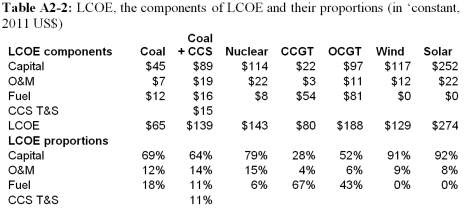

Table A1-2 and A2-2 show the proportion of “Capital” (i.e. TCR) that EPRI apparently assumed for ‘Owners Costs’, including ‘Allowance for Funds Used During Construction’ (AFUDC).

The ratio TCR/TPC is given in Tables A1-3 and A2-3. This ratio shows how much higher the TCR is than TPC for each technology. For example, for nuclear the TCR is 1.93, or 93% greater than TPC.

Discussion

This report uses the EPRI (2010) figures for LCOE and emissions intensity. These are the figures being used in Australian government reports such as ABARE (2010) and for the Treasury modelling of the carbon tax and ETS. Some discussion of the figures and assumptions is warranted.

The Total Plant Cost figure in the EPRI report is confusing because it is not the full capital cost used to calculate LCOE. The capital cost figure needed for calculating LCOE is the Total Capital Required, which includes Owner’s Costs. Back-calculating from the figures provided reveals the amount of Owner’s Costs EPRI used in their LCOE analyses. This cost is significant. It is 93% higher than the Total Plant Cost for nuclear, 88% higher for CCGT, 45% higher for coal, and 41% higher for solar thermal. The EPRI report does not make clear the basis of the Owner’s Costs or the assumptions. For example, the construction period is not stated?

EPRI uses 85% for the average lifetime capacity factor for mature technologies such as coal, gas and nuclear. However it also uses 85% for immature technologies such as carbon capture and storage, and assumes capacity factors for Wind (36.6%) and Solar Thermal (31.6% with 6 hours storage) that appear to be based on the best possible figures, rather than the average achievable over a plant’s life. It is difficult to understand how these capacity factors could be realized in practice over the plant life.

The emissions intensities do not include fugitive emissions and appear to be for the technology running at optimum efficiency, rather than average efficiency. The abatement costs for Wind and Solar are probably understated, because the capacity factors assumed seem to be unreasonably high.

The reason the OCGT abatement costs are high is because EPRI used a capacity factor of 10% for the calculation of LCOE. This is because OCGT is economic at capacity factors up to about 14% due to its high fuel costs (IPART, 2004, Exhibits 1-2 and 1-3 http://www.ipart.nsw.gov.au/documents/Pubvers_Rev_Reg_Ret_IES010304.pdf )

If we assume wind or solar are backed up with OCGT, it is clear, without needing to do detailed calculations, that wind and solar with back-up are a high-cost way to avoid emissions.

Of the options considered, CCGT is clearly the least cost way to abate CO2 emissions. For example, if we are making a decision about new baseload capacity we might compare between a new baseload coal plant withoutCCSand other options. From Figure 1, the CO2 abatement cost, compared with new black coal, is $44/t CO2 for CCGT and $107/t CO2 for nuclear.

Based on the EPRI figures, nuclear cannot be justified inAustraliaat this time because it is too expensive. For nuclear to be an economically viable option, the impediments that are causing the EPRI estimates for the cost of nuclear in Australia to be several times higher than in Korea need to be removed.

Conclusions

Of the options considered, CCGT is clearly the least cost way to abate CO2 emissions, given the EPRI assumptions.

The abatement cost with CCGT is about 40% of the abatement cost with nuclear.

Based on EPRI’s estimates, nuclear is not economically viable in Australia because it is too expensive. This situation will remain while the impediments to low-cost nuclear remain in place.

Glossary

OCGT – Open Cycle Gas Turbine

CCGT – Combined Cycle Gas Turbine

CCS – Carbon Capture and Sequestration

CST – Concentrating Solar Thermal

EPRI – Electric Power Research Institute

NREL – National Renewable Energy Laboratory

LCOE – Levelised Cost of Electricity

TCR – Total Capital Required

TPC – Total Plant Cost

AFUDC – Accumulated [or Allowance for] Funds Used During Construction (Capitalised Interest)

References

ABARE (2010), Australian Energy Projections to 2029-30: http://adl.brs.gov.au/data/warehouse/pe_abarebrs99014434/energy_proj.pdf

ACIL-Tasman (2009), Fuel resource, new entry and generation costs in the NEM: http://www.aemo.com.au/planning/419-0035.pdf

EPRI (2010), Australian Electricity Generation Technology Costs – Reference Case 2010: http://www.ret.gov.au/energy/Documents/AEGTC%202010.pdf

Independent Pricing and Regulatory Tribunal (2004) The long run marginal cost of electricity generation in NSW: http://www.ipart.nsw.gov.au/documents/Pubvers_Rev_Reg_Ret_IES010304.pdf

NREL (2011), Levelized Cost of Energy Calculator: http://www.nrel.gov/analysis/tech_lcoe.html

South CarolinaElectric & Gas Company (2011), VC Summers Nuclear Station Units 2 and 3 (June 30, 2011): http://www.scana.com/NR/rdonlyres/A830A131-9425-46F1-B948-C8424530EE49/0/2011Q2BLRAReport.pdf

Appendix 1 – Input data and intermediate calculation results with costs in ‘constant 2009 A$’

Appendix 1 summarises the significant data from the EPRI (2010) report for the seven technologies selected for this study. Costs are in ‘constant, mid-2009 A$’.

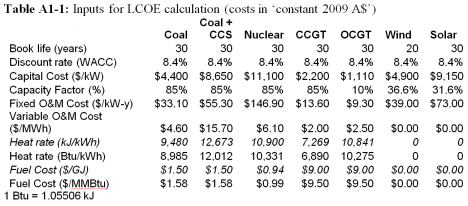

Table A1-1 lists the values needed for input to the NREL LCOE Calculator, http://www.nrel.gov/analysis/tech_lcoe.html .

The Capital Cost figure listed in Table A1-1, needed for calculating LCOE, is ‘Total Capital Required’ (TCR). But the TCR figure is not given in the EPRI report. So it must be back-calculated from the other data available in the report. The EPRI report provides the breakdown of LCOE by Capital, O&M and Fuel (Tables A1-2 and A2-2). This data was used to calculate the value EPRI used for TCR. The results are in Tables A1-3 and A2-3. These tables also give the ratio TCR/TPC. This shows how much higher the TCR is than TPC for each technology. For example, for nuclear the TCR is 1.93, or 93% greater than TPC, whereas for coal it is 48%.

Appendix 2 – Input data and intermediate calculation results with costs in ‘constant 2011 US$’

The cost figures in Appendix 1 are in ‘constant, mid-2009 A$’. In Appendix 2 they have been converted to ‘constant, mid-2011 U$’. The conversion factors are in Table A2-6.

Table A2-1 lists the values needed for input to the NREL LCOE Calculator.

Filed under: Emissions, Nuclear, Policy, Renewables

.png)

These studies are meaningless because CCS fails a simple legal test. Utilities do not want to be held responsible for causing water table damage through litigation or even just the threat of litigation could bankrupt a power company. Recently President Obama (being a lawyer) was advised that the US should not provide guarantees holding owners of CCS not responsible for environmental damage by their projects. Therefore CCS fails an important test right off the bat. The above cost comparisons are meaningless because the technology cannot move forward legally. That leaves only the nuclear option which has its own set of risks that may be viewed as too risky or may be viewed as being managable depending on who you talk to. I personally think the risks can be minimized and are managable. The risk of our extinction by not developing nuclear power is huge and far outweighs the nuclear accident risk. Taking these points into account shows that coal is dead and nuclear has a necessary future. Solar is a toy we can play with – if you can afford it. Wind is too erratic to be the major source of energy in our overall power supply.

Following

1)This is interesting and I agree that it would be desirable to understand what adds to the cost of nuclear in many countries. Regulatory regimes are certainly very different and looking at NRC, for example, you get the feeling that they see their primary duty to be an obstacle for the construction of new NPPs in US rather than as a facilitator of (more) safe nuclear power.

2)The assumed gas prices seemed rather conservative and in a world where half the planet thinks gas is a cheap and easy way to lower CO2 emissions and where oil production might be peaking, I think the assumed prices can be reasonably questioned.

3)Finally, while I think this type of estimates have their own uses they also have serious shortcomings since they fail to ask whether to choosen alternative actually gets the job done. Emissions reductions we get from using gas (even when ignoring methane leakage) are too small by far. Also, CCS doesn’t capture all the CO2 and what is left can quite easily be intolerable if we are to reach the kind of reductions IPCC talks about (…let alone more aggressive 350ppm goals). In the end the cost comparisons that are most meaningful with climate change in mind, are those between alternative energy infrastructures that do get the job done rather than between those getting us, for example, 30% closer to the target but leaving the underlying problem unsolved.

Jani, you said “let alone more aggressive 350ppm goals”. 350 ppm is history. We are nearly at 400 ppm and going up. Stopping all CO2 release doesn’t get us back to a lower CO2 level since the total is cumulative. I sometimes wonder if a lot of people (350.org and our political leaders) think that dropping the CO2 production level also drops the total ppm level. If they think this, they just dont understand the cumulative nature of the total CO2 level. Because of this cumulative effect, all forms of CO2 production need to be eliminated as soon as possible. This concept is not yet in the mental psyche of people around the world. By the way I agree with all your points Jani.

Gene, I haven’t followed 350ppm movement very closely, but my understading has been that they want to eventually see forest cover increasing again. This would tie down co2 from the atmosphere.

How fast would planting trees lower the CO2? I have a gut feeling that planting trees is not going to have much effect except over millenia.

This is from WAAAYYY out in left field but…you know….if we returned the entire state of Nebraska and Iowa back to Prairie (the Prairie of the American Great Plains were super rich, dense forms of vegetation. Grasses with extensive root systems, where the carbon is deposited) we could drain the atmosphere of CO2 back to 1900 levels. Just say’n 🙂

I have attempted to find the average lifespan of Natural Gas fired turbines. My research, and i by no means maintain that it is comprehensive, suggests that it falls from 50,000 to 65,000 operational hours. Or at maximum, after about 8 years of continuous use the turbine must be replaced. 9 years if we assume a 90% capacity factor of nuclear power plants.

The cost distortions that have been omitted are not trivial. CO2 will cost $23/t from next July rising to about $29 in 2015. After that the auctioned price could go higher or lower but with a floor of $15 if I recall. The Renewable Energy Certificate subsidy will average $39 per Mwh this year and should be added as a cost to wind and solar.

Other cost factors can go either way such as the exchange rate. Since nobody knows if CCS is viable cost estimates would gave to be suspect. Note that some favoured projects such as the ‘solar flagships’ will get 45% of their capital costs paid by the Federal govt with no interest or dividend payments required. Of particular importance to southern Australia will be the gas price. If nearby gas sources have to be replaced by distant sources current prices paid could double.

Cost of CO2 avoided may be a short term and not a long term decision criterion. US power company Exelon claims that gas is cheaper than new nuclear and even in carbon taxed Australia TRU Energy appears to favour gas for new projects. Is this gas lock-in a wise move for the future?

The analysis is obviously nonsense because you are mitigating coal CO2 with coal. The cost of mitigating with nuclear cannot be as high as mitigating with coal because burning coal is not mitigating at all.

What we have to do to mitigate is to shut down coal and natural gas, not switch from coal to coal. Switching from coal to coal should show an infinite cost of mitigation.

There is an obvious misrepresentation in the cost of nuclear because nuclear is the cheapest and only way to actually mitigate.

Jani, on your point 3, I think this is key.

If you are concerned with mitigating climate change rather than just CO2, then gas-fired power stations are not the right technology. This is because the difference between the reduced positive CO2 forcing [from fossil gas combustion and methane leakage] and the diminished negative aerosol forcing is roughly zero [see Wigley analysis], whereas for nuclear there is also the diminished aerosol forcing (like gas), but NOT a positive CO2 or methane forcing, hence the net effect is still a substantial negative forcing. Looking to the bottom line, it is the negative forcing that matters for climate change.

Also, on CCS, we state in our Energy paper (Nicholson et al 2011):

Gene Preston @ 2 November 2011 at 10:41 PM

I agree with your comments about CCS. However, this is just one of the seven new technologies considered, so I don’t understand how you can dismiss the other six comparisons as your first sentence says:

By the way, I added the “Black Coal with CCS” technology as an after-thought. I added it because of comments a few days ago which argued that any comparison with coal should be for coal with CCS.

Jani Martikainen, @ 3 November 2011 at 12:48 AM:

Thank you. This is the only comment so far that seems to have made an attempt to understand the paper and to get to grips with the reality – nuclear is too expensive to be viable at the moment.

The fuel price assumptions are directly from the EPRI report. The EPRI report explains that is a large difference between west coast (high) and east coast (low) gas prices. They explain that it is not valid to average them, but since this is a study for Australia responding to the Australian Government’s terms of reference, that is what they did. I’d urge anyone who wants to argue about the EPRI assumptions to read the EPRI report first.

That is a different issue. This paper is intended to compare some selected technologies, being advocated for Australia, on the basis of their cost of electricity and the cost of emissions abatement. We need to do this as a first step, before we apply incentives and disincentives, so we can see how large the incentives and disincentives would have to be to make each technology viable. This analysis shows that CCGT is the least cost way to reduce emissions at this point in time. If we want nuclear, we’d better start looking into what is making it too expensive.

Charles Barton @ 3 November 2011 at 4:09 AM

The ‘book life’ for LCOE is usually taken to be 30 years in most of the studies I’ve seen. It is the period over which the capital cost is depreciated.

Please read the EPRI report to understand the EPRI assumptions.

John Newlands @ 3 November 2011 at 5:51 AM

The CO2 tax and ETS legislation will most likely be repealed (in the opinion of many). It cannot survive in a world that is not heading to implement an international ETS, which it is not. But the CO2 tax and ETS is OT for this thread.

Asteroid Miner @ 3 November 2011 at 7:32 AM

You comment suggests you did not read the paper very carefully.

Asteroid Miner, on 3 November 2011 at 7:32 AM said:

The analysis is obviously nonsense because you are mitigating coal CO2 with coal

You are mitigating a 1970′s sub critical coal fired plant with a 2010 super or ultra super critical coal fired plant. 25-28% efficiency vs 38% or 45% efficiency. It might not be as much a reduction in emissions as some would like but it would still represent a reduction.

@Gene Preston and others

James Hansen estimates that a maximal global reforestation effort would reduce atmospheric CO2 by about 50 ppm.

http://www.giss.nasa.gov/research/briefs/hansen_13/

That combined with very aggressive emissions cuts might make 350 ppm possible. Unfortunately, reality is somewhat different.

Following.

Thanks Peter for this clear and well-argued analysis of a complex subject.

Let’s revisit the nuclear cost question again. I checked the EPRI report and found no mention of the Korean APR1400. Since the UAE deal for four reactors was signed in 2009, I wonder why the APR1400 was not included. The UAE deal was for four 1,400 MWe reactors at $20 billion (mostly fixed cost!). That gives 5.6 GWe divided by 20 billion US dollars for a cost per kW of $3570 or 25% less than used by EPRI.

Can someone verify that I am comparing apples to apples?

Are there cultural reasons Australians can not buy from Asians?

Thanks for pulling this information together Peter.

The costs calculated in the analysis should be understood as the cost to remove the first tonne of CO2 emissions from the system. Lets not lose sight of our goal though: what is the cost of removing the last tonne of CO2 emissions from the system?

This cost is infinite for CCGT, OCGT, and black coal, because these technologies are simply not capable. It converges (perhaps diverges) towards a very large number for wind & solar, much larger than the EPRI cost used here.

Likewise coal + CCS appears to approach an arbitrarily large number as soon as we try to implement it – witness the closure of the UK’s last CCS scheme at Longannet in the same week as the closure of the only serious Australian CCS venture, Zerogen in QLD.

So for removal of the last tonne of emissions, rather than currently being more expensive, nuclear power is already the cheapest way to abate emissions from existing plant.

The ultimate value of any piece of analysis is, how does it inform or change any decision that we can make today? We could be making a decision today to build nuclear power. But we can only choose today to be building nuclear power in, say, 2020, because of the engineering and policy lead times. The choice between displacing Hazelwood with either nuclear or CCGT at today’s gas prices does not lie within our possible futures. The only choice that we get to make today is between displacing Hazelwood with either nuclear, or CCGT at 2020 fuel prices. And similarly for the other displacement options. And I’m prepared to accept John Newlands argument that gas will be much more expensive in 2020 than today.

(Call it the Special Theory of Political Relativity if you like – we can only make choices between events that could occur beyond a political implementation horizon that recedes from us at the speed of decision making.)

So even for removal of the first tonne of emissions, Peter’s analysis shows that it is highly likely that nuclear power is already the cheapest displacement choice we can make today.

We don’t need to make nuclear power cheaper, its already the cheapest available choice, today, for displacement of both the first and the last tonne of CO2 emissions.

Solid analysis, the justifications behind inputs and assumptions look fair, after a quick gloss over them.

I have to agree with points by Jani Martikainen, Barry Brook and John Morgain, i.e. the need to mitigate climate change, not just the cost of removing the first tonne of CO2. It does seem a little pointless estimating the abatement cost of replacing coal without ccs with more efficient coal without ccs (why bother?).

I note that the EPRI report states “Overall EPRI anticipates the capital cost of a nuclear power plant deployed in 2030 will be 15% less than one built in 2015.” (I can’t find their justification for this figure?)

If you play around with the excel inputs to accomodate for this assumed decrease in capital cost (85% of $US114 = $US97), it changes the resulting LCOE from US$143 to US$126, which changes the CO2 abatement cost at Liddell (where abatement cost is highest) from US$105/t to US$89/t. I wonder if this is a fair estimate for the cost of (what John Morgan referred to as) removing the last tonne of CO2 from the system?

By the looks of these results, Hazelwood is certainly a first contender to be replaced (and rightfully so).

[…] Brave New Climate: CO2 abatement cost with electricity generation options in Australia. […]

Martin Burkle,

Thank you for your comments and questions.

The EPRI report explains how they have estimated the cost for nuclear power in Australia. I’d urge BNCers to read and comprehend that if there aregument is with the EPRI estimates. However, I’d remide all that the EPRI figures are the ones htat have been commissioned by the Australian government and are being used in their modelling and analyses. So it is unlikely we will find a major flaw in them Therefore, I’d suggest it is best to work with the numbers currently available. Anyone wants to test different assumptions can download the Excel spreadsheet, vary the assumptions and see the effect.

I believe the figure for capital cost of the UAE project and the EPRI ‘Total Capital Required” are equivalent figures. So yes, you are comparing apples with apples on that basis. But there appears to be many factors which would make nuclear far more expensive than in UAE, and more expensive than in USA. One of them is that Australian labour productivity is lower and labour rates are higher than in USA. According to EPRI the uplift factor is 1.73, so the labour costs for the Australian component would be 73% higher in Australia than in USA. See the EPRI report for the details and the breakdown.

There are no legislated “cultural reasons Australians can not buy from Asia”. But I suspect, there is a strong view at present Australia should align its nuclear regulation with the USA nuclear regulatory regime. I believe doing so would cause Australia to commit to high cost nuclear for many decades.

Peter, Thanks for this analysis – at least it gives me a reason why the Govt keeps saying nuclear is too expensive, but I do admit that I don’t understand why “owner’s cost” for a nuclear plant should be 93% greater than the establishment cost in Aus which is several times higher than in Korea. Is this due to insurance? I would like to see how the Northern Power Station at Port Augusta in my home state compares. I have heard it is even dirtier than Hazelwood. It has a power output of 520-544MW and emits 3.6 million tonnes of greenhouse gas a year. I have been expecting that Alinta will replace it with an Open Cycle natural gas turbine plant using Moomba gas. Of course it is not a bad location for our first nuclear plant, producing desal water for the Roxby mine.

Re solar, I have always been skeptical of it as a large scale power source since I experienced first hand the White Cliffs 50kW Solar Power station in the late 1980s. It was more often down and using diesel backup than operating. Maybe solar is more reliable these days.

John Patterson

Peter Lang: WRONG: “nuclear is too expensive to be viable at the moment”

“Power to Save the World; The Truth About Nuclear Energy” by Gwyneth Cravens, 2007:

Page 211: “In 2005, the production cost of electricity from nuclear power on average cost 1.72 cents per kilowatt-hour; from coal-fired plants 2.21; from natural gas 7.5, and from oil 8.09. American nuclear power reactors operated that year around the clock at about 90 percent capacity, whereas coal-fired plants operated at about 73 percent, hydroelectric plants at 29 percent, natural gas from 16 to 38 percent, wind at 27 percent, solar at 19 percent, and geothermal at 75 percent.” The costs per kilowatt hour for solar and wind are 600 or more times the cost for coal, and that is in sunny and windy places, respectively.

Asteroid Miner @ 3 November 2011 at 7:32 AM

The analysis is obviously nonsense because you are mitigating coal CO2 with coal.

You comment suggests you did not read the paper very carefully.

So you would cure morphine addiction with heroin? It is as obvoius as the emperor’s new clothes that you can’t eliminate CO2 production by burning coal. Also from Cravens:

Page 13 has a chart of greenhouse gas emissions from electricity production. Nuclear power produces less greenhouse gas [CO2] than any other source, including coal, natural gas, hydro, solar and wind. Building wind turbines and towers also involve industrial processes such as concrete and steel making.

Wind turbines produce a total of 58 grams of CO2 per kilowatt hour.

Nuclear power plants produce a total of 30 grams of CO2 per kilowatt hour, the lowest.

Coal plants produce the most, between 966 and 1306 grams of CO2 per kilowatt hour.

Solar power produces between 100 and 280 grams of CO2 per kilowatt hour.

Hydro power produces 240 grams of CO2 per kilowatt hour.

Natural gas produces between 439 and 688 grams of CO2 per kilowatt hour.

(Deleted inflammatory remark.)

harrywr2, on 3 November 2011 at 8:11 AM: “25-28% efficiency vs 38% or 45% efficiency. It might not be as much a reduction in emissions as some would like but it would still represent a reduction.”

That much reduction would be irrelevant. We are already into dangerous territory. We are above 350 ppm and above 450 ppm equivalent, with CH4 bubbling out of the Arctic ocean and CH4 bubbling out of the peat bogs thawing in the tundra.

If we don’t act immediately and take draconian action, we humans could be extinct by 2060. This is not a joke.

Please read: http://onlinelibrary.wiley.com/doi/10.1002/wcc.81/full

“Drought Under Global Warming: a Review”

See the maps of drought in the 2060s on page 15.

http://www.realclimate.org/index.php/archives/2011/10/the-moscow-warming-hole/

http://thinkprogress.org/romm/2011/10/26/353997/nature-dust-bowlification-food-insecurity

http://www.pnas.org/content/early/2011/10/18/1101766108.abstract

http://www.sciencemag.org/content/early/2011/03/16/science.1201224

http://www.fas.org/irp/agency/dod/jason/statistics.pdf

http://climateprogress.org/2010/10/20/ncar-daidrought-under-global-warming-a-review/

http://climateprogress.org/2010/12/14/southwest-drought-global-warmin/

http://climateprogress.org/2011/01/20/lester-brown-extreme-weather-climate-change-record-food-prices/

“Preliminary Analysis of a Global Drought Time Series” by Barton Paul Levenson, not yet published. Under BAU [Business As Usual], agriculture and civilization will collapse some time between 2050 and 2055 due to drought caused by GW [Global Warming].

See:

“Ecological Footprints and Bio-Capacity: Essential Elements in Sustainability Assessment” by William E. Rees, PhD, University of British Columbia and “Living Planet Report 2008″ also by Rees.

We went past the Earth’s permanent carrying capacity for humans some time in the 1980s. We are 20%+ over our limit already. And the US no longer has excess biocapacity. We are feeding on imports. 4 Billion people will die because we are 2 Billion over the carrying capacity. An overshoot must be followed by an undershoot.

Reference: “The Long Summer” by Brian Fagan and “Collapse” by Jared Diamond. When agriculture collapses, civilization collapses. Fagan and Diamond told the stories of something like 2 dozen previous very small civilizations. Most of the collapses were caused by fraction of a degree climate changes. In some cases, all of that group died. On the average, 1 out of 10,000 survived. We humans could go EXTINCT in 2051. The 1 out of 10,000 survived because he wandered in the direction of food. If the collapse is global, there is no right direction.

1. We must take extreme action now. Cut CO2 production 40% by the end of 2015. [How to do this: Replace all coal fired power plants with factory built nuclear and renewables.] Continuing to make CO2 is the greatest imaginable GENOCIDE. We have to act NOW. Acting in 2049 will not work. Nature just doesn’t work that way. All fossil fuel fired power plants must be shut down and replaced with nuclear and renewables. Target date: 2015.

2. Expect at least 4 Billion people to die because of the population overshoot. Attempt to maintain some form of civilization while this happens.

How are we feeding 7 billion now? On “mined” water. Aquifers are running dry. When the aquifers are dry, the food is gone.

For small factory built nuclear power reactors see:

http://www.world-nuclear.org/info/inf33.html

Notice that several are made in the USA.

Small Nuclear Power Reactors

Name Capacity Type Developer

KLT-40S 35 MWe PWR OKBM, Russia

VK-300 300 MWe BWR Atomenergoproekt, Russia

CAREM 27 MWe PWR CNEA & INVAP, Argentina

IRIS 100-335 MWe PWR Westinghouse-led, international

Westinghouse SMR 200 MWe PWR Westinghouse, USA

mPower 125 MWe PWR Babcock & Wilcox, USA

SMART 100 MWe PWR KAERI, South Korea

NuScale 45 MWe PWR NuScale Power, USA

HTR-PM 2×105 MWe HTR INET & Huaneng, China

PBMR 80 MWe HTR Eskom, South Africa

GT-MHR 285 MWe HTR General Atomics (USA), Rosatom (Russia)

BREST 300 MWe FNR RDIPE, Russia

SVBR-100 100 MWe FNR Rosatom/En+, Russia

Hyperion PM 25 MWe FNR Hyperion, USA

Prism 311 MWe FNR GE-Hitachi, USA

FUJI 100 MWe MSR ITHMSO, Japan-Russia-USA

Hyperion from Arizona, USA has quoted me a retail cost of 5.5 cents per kilowatt hour. http://www.hyperionpowergeneration.com/

================

For Advanced Nuclear Power Reactors see:

http://www.world-nuclear.org/info/inf08.html

Third-generation reactors have:

a standardised design for each type to expedite licensing, reduce capital cost and reduce construction time,

The US Nuclear Regulatory Commission (NRC) gave final design certification for both in May 1997, noting that they exceeded NRC \”safety goals by several orders of magnitude\”.

The Westinghouse AP600 gained NRC final design certification in 1999 (AP = Advanced Passive).

These NRC approvals were the first such generic certifications to be issued and are valid for 15 years. As a result of an exhaustive public process, safety issues within the scope of the certified designs have been fully resolved and hence will not be open to legal challenge during licensing for particular plants. US utilities will be able to obtain a single NRC licence to both construct and operate a reactor before construction begins. etc.

See: http://www.realclimate.org/index.php/archives/2011/11/keystone-xl-game-over/

“Keystone XL: Game over?”

Do you understand what “Game over” means?

John Morgan, 3 November 2011 at 10:10 AM

Thank you for your comment. This response has got a bit long and convoluted, but I’ll post it anyway. I know you will get to the substance of it. 🙂

I disagree with your statement of the goal. The goal of this paper is to compare the abatement costs of different technologies. That is the sort of decision being made about CCGT to replace Hazelwood and new coal or CCGT for NSW. The analysis uses the best currently available information, which was provided by EPRI and which is the basis for the government’s analyses.

You have stated a system wide goal. That is not what this paper focuses on. However, as an aside, I think your statement of the system goal is not correct. The system goal is “what is the discounted cost of removing, not the last tonne but the <average tonne, of CO2 emissions from the system”. On a discounted cost basis the cost of removing the first tonnes is the most important.

Removing the last tonne is at least 40 years away. At that time the inputs to the analysis will be different. Right now, we must make the decision between options on the basis of which option will give the least LCOE and least abatement cost for the life of the next plant to be built.

I disagree. Consider the process for making a decision at some time in the future. The process will be the same as now. The decision will be which plant to build. If existing plants such as Hazelwood or Liddell still exist, the analysis will be the same. If we are making a decision about adding new capacity, the abatement cost analysis will still be the same analysis.

I agree that purchase decisions must be made now on the best estimate of LCOE (and therefore of fuel prices) for the life of the plant. Most analyses take into account the forecast cost of fuel over the projection period, as does the ACIL-Tasman report (see Section 4.2 and Tables 44 and 48: http://www.aemo.com.au/planning/419-0035.pdf ). Also remember there has been a significant decline in US gas prices over the past few years (due to coal seam gas), and similar may happen in Australia. So gas price forecasts are uncertain. Debating that assumption is another issue.

I agree.

It is clear nuclear is not economically viable in Australia at the moment, and will not be by 2020 unless we remove the impediments to low-cost nuclear. Most people doing the calculation are concluding just that. So if we want nuclear to be a realistic option, we need to investigate what needs to be done to allow it to be economic.

This is basically an argument about the projected gas price assumptions for 2020 and for the plant life. I agree that if we change EPRI’s assumptions it will change the results. EPRI conducted sensitivity analyses on capital, O&M, and Fuel costs for all technologies. They are presented in Section 10 http://www.ret.gov.au/energy/Documents/AEGTC%202010.pdf . I will run an analysis with different inputs and report later.

John, I am surprised by that statement. I cannot see evidence to support it. I am open to be persuaded so I hope you will present the case.

Asteroid Miner, you are preaching to the converted when it comes to SMRs. However, you might want to dampen your enthusiasm for them at this stage until there are some prototypes and commercial units built.

The only solid buyers that I’ve heard of recently are TVA, who are building some B&W mPower units. Hyperion hasn’t built a prototype yet and has no solid customers or NRC design approval.

There’s also the Akademik Lomonosov floating plant, but that’s up in the air at the moment.

The AP600 had no buyers and based on feedback from existing nuclear power customers they increased the output to 1150MW.

All of this reflects the current trends in nuclear power: China is driving development in high output (1GW+), evolved LWR designs and on the other hand there is a focus on SMRs in terms of R&D effort.

We’ll need both but if the climate threat is as serious as you suggest then we will need to build off-the-shelf Gen III reactor designs right now and get to building fast breeder prototypes to consume their spent fuel fast, perhaps as SMRs. France did a decent build-out of large nuclear power plants and if the climate problem was treated with the urgency it deserves then full electricity-sector decarbonisation could be achieved within <15 years in countries with existing nuclear regulatory frameworks.

LFTRs will be irrelevant for 5+ years unless there is a Manhattan Project-style crash program to develop and mass-produce them. This isn’tr to say that it’s impossible (I’m watching Flibe Energy’s work with the US Army as close as I can) but unless there a tectonic shift in politics then it probably won’t happen very fast at all.

As for:

"So you would cure morphine addiction with heroin? It is as obvoius as the emperor’s new clothes that you can’t eliminate CO2 production by burning coal."

It’s pretty obvious that you still haven’t read the paper. Emissions reduction can be done by using more efficient coal-powered generators – however, the deep cuts in emissions intensity for baseload power supply will require nuclear power in order to keep CO2 levels at current levels.

John Morgan @ 3 November 2011 at 10:10 AM

The EPRI report gives the projected costs in 2015 and 2030. the costs are in ‘Constant, 2009 A$’. Therefore, referring to 2020 prices could be confusing. What I understand you and John Newlands to mean is that you expect a real cost increase in gas prices – that is an increase above inflation. I am not sure what figure you have in mind for the price in 2020 (given in 2009 A$). I have run an analysis with gas at $12/GJ (constant, 2009 A$), which is the upper end of the range used in the EPRI sensitivity analyses for 2015. At this gas price and with no other changes CCGT still has the lowest CO2 abatement cost of the low emission technologies.

@Peter Lang “You have stated a system wide goal. That is not what this paper focuses on. However, as an aside, I think your statement of the system goal is not correct. The system goal is “what is the discounted cost of removing, not the last tonne but the <average tonne, of CO2 emissions from the system”. On a discounted cost basis the cost of removing the first tonnes is the most important.

Removing the last tonne is at least 40 years away. At that time the inputs to the analysis will be different. Right now, we must make the decision between options on the basis of which option will give the least LCOE and least abatement cost for the life of the next plant to be built."

I see your point, but the trouble I have with this is that it seems to assume that you find the decarbonized solution by always, at each moment of time, picking the lowest abatement cost alternative. The picture I have in mind is "energy landscape" with different technologies on different axis and the CO2 emission along the last axis..i..e CO2(tech1, tech2, tech3…). I see the danger that by following locally optimal steps, we end up in a local minimum of CO2 (with too high emissions) and not the global one that we must reach. Then making a jump from that one to the final solution could end up costlier than it should be. I am not being very clear right now, but I hope you see what I am trying to grasp.

Also, decisions we make today influence future costs. For example, first of a kind nuclear costs are higher and sooner we start learning faster the costs are lowered. Considering that in the case of nuclear costs that you quote are already fairly close to fossil alternatives it is not unreasonable to expect modest cost reduction which will make it the cheapest alternative. Paying a bit extra now, could get us moving into the direction of the global minimum. So as a picture, think we are on a mountain top. One side has a steep slope right away, but end ups only into a valley half way down hill. The other side starts with somewhat less steep slope, but the slope gets steeper and the route actually ends up all the way downhill. If we pick the first choice, there is the danger (danger not certainty) that we must eventually climb back up again to get where we wanted to get.

Thanks for your comments Peter. I understand where you’ve drawn the scope of your analysis. When I say our goal is to remove the last tonne of carbon emissions, I realize thats beyond the scope you’ve set yourself, but offer it to set what I think is the broader context in which these discussions reside. Let me expand on the comments of mine you disagree with.

We can’t remove the last tonne by replacement with OCGT or CCGT. I don’t believe it can be done with coal + CCS, since we don’t seem capable of removing a first tonne with this tech. I don’t believe it can be done with wind or solar, because the diminishing return as those technologies increase penetration will hit an integration wall long before the last tonne drops. That leaves nuclear as the only capable technology for final decarbonization, and so by exhaustion the cheapest.

I make the assumption here that gas prices will be significantly more expensive in a decade. That can be questioned, but it is the basis for my statement. My assumption is that the cost increase will offset the difference that separates nuclear from OCGT at current fuel prices. Since the choice we can make today is between a nuclear plant in, say, a decade, with a sixty year plant life, and OCGT in, say, a year with a thirty year plant life (I’ve no idea what typical life is), we need to consider gas cost 10, 20, 30 years out. I think gas will be much more expensive then even if it is still cheap in 2020.

So for today’s choice, even for the first tonne of carbon, I still think nuclear is likely to prove the cheapest available abatement technology.

Jani Martikainen, @ 3 November 2011 at 7:29 PM

Thank you for your comment

I think I understand what you are getting at. I agree with what I think you saying.

If I’ve understood you correctly, our agendas have similarities. In short this is mine:

To cut world emissions most of the effort has to be in the developing countries because they are the ones that will ramp up energy use as Japan did after WWII, followed by China, India, Indonesia and others. The rest of the developing world will go through this development cycle too. So what the developed world does in cutting its emissions is less important than providing low emission, electricity generation technologies for the developing world at a cost less than fossil fuel technologies. Therefore, our role should be focused on developing the technology. In the short term it means implementing Gen II and Gen III at the lowest possible cost. Australia should be aiming for an LCOE as near to Korea’s as is achievable. To achieve that means removing the impediments to low-cost nuclear.

The main aim of the lead article was to try to encourage BNC regulars to recognise and accept that nuclear is too expensive to be viable in Australia at the moment. We need to focus our attention on how to overcome that.

We also need to get over the idea that the CO2 tax and ETS is any sort of solution at all. It will not survive and even if it did it is not a solution because it does not help to get low cost nuclear. It protects it from the full magnitude of the cost reduction that is needed. That will not help to get it cheaper than coal, quickly.

I agree that the faster we get rolling out nuclear the faster costs will come down. We need to address the politics and educate the population. We also need to stop “kicking own goals” like the CO2 tax. That legislation has set back progress in Australia by at least 5 years IMO.

Regarding your last paragraph, I wonder if you have seen the section in this comment titled Nuclear cheaper than coal in Australia. How?

http://bravenewclimate.com/2011/07/06/carbon-tax-australia-2011/#comment-136436

I believe this is saying similar to what you are advocating in your last paragraph. It suggests what needs to be done to get to n’th of a kind cheaper than call. It provides rough costs and the total public funding needed for the first 10 GW.

John Morgan,

Thank you again. I’ll ponder on your comment overnight. Here is my initial reaction:

I agree with all of that up until the last four words: “ so by exhaustion the cheapest.”. The least cost solution will be the one that gives the least total cost on a discounted cash flow basis over the entire period. The least cost solution will be to build the plants that abate emissions at least cost first. Being pragmatic, we will need fossil fuel generation for a long time, much longer than the life of the initial plants. From another perspective, the political reality is either we go the least cost route or don’t do anything. The population is not likely to support nuclear if there is a lower cost solution available. Therefore, it seems clear to me, the choices are:

1. keep using coal until nuclear is cheaper

2. go gas, or

3. face up to the facts: nuclear is priced to high because of the impediments we (society) has caused our governments to place on it. Therefore, we can remove those impediments. The first step needs to be to identify the impediments.

Regarding your second point and the assumption about gas prices, most LCOE analyses are based on projected fuel prices for the plant life. I don’t recall what the EPRI report assumed, and they may not have made it explicit, but the assumptions are explicit, detailed, and based on specific Australian east coast information in the ACIL Tasman (2009) report, Section 4.2 http://www.aemo.com.au/planning/419-0035.pdf

@Peter: Thanks for you comment and I agree with what you say. At some moral level I would like to see carbon taxes, but I don’t see anyway for that to happen without the system leaking massively so that it doesn’t actually achieve anything other than higher energy costs and weakening public interest in emission reductions. Only convincing long term solution is zero carbon energy source that really is cheaper than fossil fuels. It is possible with nuclear, but it requires appropriate regulatory and political superstructure. There certainly can be (and are) systems where nuclear is not the cheapest choice. Investors on NPPs must be certain that their investment is welcome and regulations should be such that they encourage the evolution of reactor designs towards breeders.

I have little sympathy towards those who seem happy to let the energy prices go through the roof. I do not think they actually know how much industrialized countries spend on energy and that this spending pretty much makes everything else possible. If they would know this, they would also very quickly notice how crazy priorities they are making. I think here in Finland goverment spends less on health care (as a fraction of GDP) than we pay for energy. We pay somewhat more on pensions, and by 2030 that share is set to rise by about 3% to about 15% of GDP. This is widely considered a huge societal challenge, but the kind of energy cost increases some greens nonchalantly have in mind imply massively larger challenges. By the time people actually have to prioritize they will (and of course they should) choose the issues of direct relevance to their well being rather than ideologically kosher voltage differences.

I am wondering how yet another calculator exists with CCGT at an 85% capacity factor. I attempted to use the spreadsheet as a calculator, and after some of the posts here (particularly Jani Martikainen’s at 7:29 on the 3rd), I feel I should try this again.

What CCGT plant operates anywhere near 85% capacity factors (CF)?. The US EIA data shows they operate at closer to 40% levels there – http://www.eia.gov/cneaf/electricity/epa/epat5p2.html. Yet the same US EIA provides estimated levelized costs based on on 87% CFs, and that gets copied around the world. I find it ludicrous.

Adjusting only the CF for CCGT, by changing the LCOE’s capital component by 85/40, nuclear and CCGT become essentially the same costs as solutions for abating CO2 emissions, while CCGT remains a more attractive option in terms of $/MWh.

That covers the reasons it is getting built. It is more flexible than baseload and utilized primarily as the intermediate supply that comes on to match the day’s demand and goes away for the night’s low demand.

I couldn’t work out how the capital component of LCOE was being populated in the spreadsheet, and need to move on the more pressing matters now, but I’ll return to reality in the hopes more talented folks than I can model it.

There is a system supply requirement that comes from peak demand. If a portion of that supply (coal) is being removed, you need to measure how to replace it. Wind has a capacity value of under 10% many places (I saw 3% reference on this site for an Australian location) — so if you choose wind as the replacement you must also choose a source with the capacity value to actually replace the coal. If the CF of wind is 36.6%, then the CF of it’s complementary peaking source cannot be above 63.4%. Right?

So the calculator needs to be a matrix, where one change impacts another, both for level of supply, and CF.

I suspect the cheapest option for an entire system (that lacks hydro) is nuclear set at the level of minimum demand, and CCGT set to match the remainder of winter peak. Simplifying some figures from my Canadian province, 10GW of nuclear and 10GW of CCGT would be in the right ballpark. Average demand is about 16GW, so even in this scenario CCGT would only have a 60% CF. In fact in my area summer peak is higher, and I assume that could be met with solar – but that would reduce the overall CF of CCGT once again.

The ideal matrix here would then recognize the reality Germany has experienced. If you add wind, on a must take all output basis (which you’d have to for a high CF), that must reduce either the nuclear CF or, more likely, nuclear supply – meaning more CCGT.

The CO2 abatement cost is negative in that case.

Which we know is true.

I suspect the best way to get the cost of nuclear down is to get the motivation for expanding nuclear up. A more realistic evaluation of supposed alternatives might be helpful.

From the EPRI report, “An overall weighted Crew Rate Factor was calculated to be approximately 1.71, which is higher

than anticipated. ”

I’m in the United States and worry that the United States can not build nuclear due to the millions of hours required and the labor cost. To think that the labor component would be 1.71 times more than in the US is really hard for me to believe. Can someone explain whether this difference is due mainly to higher wages or being less skilled in the use of construction tools?

Is there anyplace to read about how labor is managed and paid in Korea or China as compared to the US or France?

Martin Burkle, on 4 November 2011 at 2:51 AM said:

Can someone explain whether this difference is due mainly to higher wages or being less skilled in the use of construction tools?

Workplace compensation rules…Australian’s have rules like if you aren’t given lunch break between noon and 1 pm then you are paid double-time until you get your lunch-break. They also get allowances for traveling to the job site, tools etc etc etc.

http://www.commerce.wa.gov.au/labourrelations/PDF/Awards/B/BuildingTradesConstructionAward.pdf

Building nuclear power plants involve lots of concrete. Stopping a continuous pour between noon and 1 pm everyday so everyone can go have lunch isn’t practical.

US Iron workers rates from http://www.bls.gov/oco/ocos215.htm

“In May 2008, median hourly wages of structural iron and steel workers were $20.68. The middle 50 percent earned between $15.18 and $29.15. The lowest 10 percent earned less than $12.25, and the highest 10 percent earned more than $37.04.

In May 2008, median hourly wages of reinforcing iron and rebar workers were $19.18. The middle 50 percent earned between $14.35 and $27.29. The lowest 10 percent earned less than $11.78, and the highest 10 percent earned more than $35.26.”

These hourly rates are about the same as the Australian hourly rates. My currency converter says $20 US is the same as 19.60 Ausy. So I conclude that the basic labor rates are the same in the US and in Australia.

Do you really think that Australian work rules add 70% to the cost of labor? That would be $20 an hour for work and $14 an hour for rules over and above the work rules in the US. If that’s the way it works, how do you expect to build any kind of serious energy infrastructure?

Martin Burkle, on 4 November 2011 at 6:04 AM said:

Do you really think that Australian work rules add 70% to the cost of labor?

Table 4-1 list productivity factors for steel work.

http://www.ret.gov.au/energy/Documents/AEGTC%202010.pdf

The Australian’s are better then Americans in terms of productivity on ‘fabricated steel’ as you get into lighter steel pieces Australian productivity drops to half.

I would speculate some sort of ‘lifting rule’ must be the explanation as the ‘fabricated heavy’ steel would be all crane work and the lighter pieces would involve people lifting something.

Since Australian’s are better at setting prefabricated pieces into place then a design that will be cost efficient for them has to have a higher prefabrication percentage.

(Deleted OT comments)

The conversion from coal to nuclear is the easiest conversion to make because we already have the technology. From coal to nuclear is also the biggest single wedge. The only problem is that the public has been propagandized by the coal industry into fearing all things nuclear. That can be cured with education.

MODERATOR

Some of your comment has been deleted as it is off topic on this thread.It is also a violation of BNC Comments Policy to make personal remarks or attribute motives to another commenter. BNC accepts the scientific consensus for AGW/CC

and no longer discusses or posts climate denialism. It is, therefore, not necessary for you to repeat the accepted BNC premise and is unfair to other commenters who, due to the new policy, have no right of reply.

Jani Martikainen, @ 3 November 2011 at 10:26 PM

Thank you for your comment.

We agree that the CO2 tax and ETS is no solution. In fact it will have the opposite of the desired effect.

I recognise that some people argue for a CO2e price on moral grounds. However, I’d argue it is highly immoral. There is no benefit but it would damage economies and, therefore, human wellbeing. So it is immoral.

Why there is no benefit: It won’t reduce world emissions, can’t work, and won’t be implemented http://bravenewclimate.com/2011/07/06/carbon-tax-australia-2011/#comment-140631 . It can’t work internationally. We can’t even measure CO2 emissions well enough to trade it in USA, EU or Australia. So what chance is there of measuring the emissions in Eretria or Ethiopia or anywhere? Therefore, there will be no international trading scheme. Most people have realised this by now e.g. A few are still hanging on.

I agree. Therefore, that is where we should be focusing our attention. We will not get nuclear seriously considered, let alone implemented, in Australia while LCOE of nuclear is far higher than with CCGT and the abatement cost per tonne is far higher than with CCGT.

If we want to seriously consider nuclear in Australia we need to:

• Identify all the impediments to low-cost nuclear in Australia, and all the energy market distortions

• Identify which could be removed

• Prioritise them for removal

• Define policy options for removing them

• Define what else would be needed to get nuclear through to the “settled down costs” (in Australia) stage

But before we can begin to tackle this,we need to get acceptance, especially from nuclear proponents, that nuclear is not an ecomically viable option for Australia at the moment. Therefore, it will not be given serious consideration. Worse still, IMO the CO2 tax and ETS legislation has delayed nuclear being put back on the political agenda for at least 5 years (unless the Labor dumps its anti-nuke policy at National Convention in December).

I agree totally with your last paragraph. I would add that the reason nuclear in Australia would be such high cost is because of 50 years of accumulated government interventions in the energy market (here and in other western democracies). We need to look afresh at all of this. Start looking at it from the perspective of a clean sheet of paper.

In summary,

Step one: recognise and accept the fact that nuclear is not a viable option for Australia at the moment.

Step two, identify the impediments to low cost nuclear in Australia.

It would also help if we could stop being distracted by advocating for the CO2 tax and ETS.

MODERATOR

Peter – your answer to JM is veering off topic and into the Carbon Tax discussion area. Please keep to the appropriate thread and do not use remarks on other threads to re-iterate your already widely espoused views on this matter. Further instances will be deleted.

Scott Luft, @ 4 November 2011 at 12:56 AM

Thank you for your comment. You make some good points, however …

Scott, and all readers, can I plead with you to read the EPRI report if you want to argue about the assumptions they used and their justification. Based on the reports I’ve seen over the past 30 years which compare LCOE of baseload technologies, nearly all use a common capacity factor to facilitate comparison. Then you can change inputs to see the effect of different assumptions.

The EPRI (2010) report applies a capacity factor of 10% for OCGT which is realistic because OCGT is used for peaking. However, the ACIL Tasman (2009) report uses a capacity factor of 85% for all technologies, including OCGT, to facilitate comparison despite the fact OCGT would not be dispatched to operate at 85% CF.

It is standard practice to apply consistent factors across the technologies to minimise the number of variables. If we did not do that, we would find nuclear has a higher LCOE because the discount rate would be higher for nuclear (higher financial risk therefore higher cost of money) than for CCGT.

OK. The spreadsheet is not well documented. You need to use the NREL LCOE calculator to calculate the LCOE. The spreadsheet is not doing that calculation. You must enter the LCOE in row 33.

Regarding the matrix you suggest, the answer is yes of course. But that requires sophisticated system wide modelling capability. We can’t do that on simple spreadsheets and post it in articles here. That is done by groups with huge resources, and a lot of consideration about boundary conditions and inputs. The key point of this paper is to try to get readers here to understand why it is generally accepted that nuclear is not economically viable in Australia at the moment. Once people accept that, we can move on to investigating what is making it too expensive and what would need to be done to allow it to be economically viable.

Funny you should mention that. I knew some one would say something along the lines. So burried a little surprise in the spreadsheet. Unhide columns L, M N. (hide column K to avoid confusion). This calculates the LCOE and CO2 abatement cost for 30% wind and 55% OCGT (total 85% capacity factor so the results are comparable with the other baseload technologies). The LCOE for 30% wind and 55% OCGT is $109/MWh (in 2011 US$). The abatement cost is $132/tonne. (I think this is correct, but haven’t checked it carefully).

No. That is not the case while nuclear is more expensive than coal. Our current system is the cheapest option. It will also be the cheapest option in the developing countries. So forcing high cost electricity on Australia will make no difference to world emissions. I’d agree with your statement if we can remove the impediments to low cost nuclear. Until we are prepared to do that, nuclear will remain a high cost way to generate electricity in Australia.

Harrywr2,

Thank you for those excellent explanations about why labour costs more in Australia than in USA. Before I read your comments I’d written the response below, which I will post even though you have provided excellent explanations.

Martin Burkle, on 4 November 2011 at 2:51 AM

Well done. You have zoomed in on one of the critical issues that are making nuclear much higher cost than it should be. There are other factors too, but let’s deal with this one here and hope others may find and point out the other impediments to low cost nuclear.

The EPRI report gives a breakdown of the labour rates and the productivity factors that combine to make the overall factor of 1.71. The method is not new. EPRI and others have been doing this for a long time. EPRI did similar for converting US costs to Australian costs for coal and nuclear for their 2006 report to the Uranium Mining, Processing and Nuclear Energy (UMPNE) report for the Howard Government. In that they explained how they calibrated the figures. http://pandora.nla.gov.au/pan/66043/20061201-0000/www.dpmc.gov.au/umpner/docs/commissioned/EPRI_report.pdf

The reason is not quite as simple as that. It has more to do with our industrial relations environment. (Deleted un-supported personal/political opinion)

In short, Australia’s labour component of the NPP would cost some 1.71 times more than in the USA, and the USA’s labour component would cost more than in Korea or UAE. If the local labour component is 50% of the total capital required, and if local labour cost is say three times Korea’s, then the capital component of an NPP in Australia would be double the cost of the same plant in Korea.

Peter Lang,

http://www.bbc.co.uk/news/world-asia-15552687

Bangladesh has agreed to build two new nuclear power plants with Russian help as the country looks to close a yawning power deficit.

The developing world has impediments other then cost to adopting nuclear. The EPRI price comparisons if one put in Bangladesh labor rates and coal extraction costs would look completely different.

Harrywr2, or any one else, can you provide a link to a breakdown of the capital cost of a new NPP (such as an AP1000 or CANDU 6) into its component parts such as (or how ever else it is presented that allows us to differentiate the loacl costs from the procured costs):

components procured internationally

local industry (called Australian Industry Involvement here)

local labour

Owners costs

AFUDC

@Peter

Thanks for more detail on labor costs. I have been looking at this site http://www.bls.gov/fls/ which compares manufacturing labor productivity (and other stuff). This report also shows huge differences between countries. There is much difference between countries in the EU. There is much difference between countries in Asia.

So your question about AP1000 labor costs broken down by what must me done locally and what labor can be done in another country is a very important question. Of course the reactor vessel, the steam generators, the pressurizer, the turbine, the containment vessel, the valves, and the large pumps will be made off shore. (most of these are not made in the United States either) But there are 200 piping, and wall modules that could be made off shore also. If you made everything overseas and assembled locally, how much local labor is involved?

As long as we are thinking about labor, has anyone thought about operations labor? The AP1000 advertising talked about only 400 people needing to run a plant, but I think another 100 got added for security after 9/11. So if 500 people are needed to run a plant in the US, do you think a lot more would be needed in Australia? (Deleted unsubstantiated industrial relations figures)

Is it reasonable to think maintenance and operations would be the same in Australia as in the US? Maybe quite a bit higher (like 1.7 times?) This also would make nuclear less attractive.

MODERATOR

Please support your contentions with references.

Gene Preston — Actually, planting trees starts removing significant quantities of CO2 from the atmosphere right away. For the scale required for tree planting as the sole solution, begin with

Irrigated afforestation of the Sahara and Australian Outback to end global warming

http://www.springerlink.com/content/55436u2122u77525/

Small modular reactors (SMRs): First oof, TVA is interested in the B&W mPower but the type does not yet have NRC approval. The first SMR to obtain type approval from the NRC will be the Nuscale 45 MWe unit, in 2018-2019. It is to be built in a factory and shipped to the site, just as will the other components.

The local construction includes the civil component, foundations, concrete walls, enclosures for the so-called nuclear island and the turbine island. The remainder of the construction invovles some extremely careful pipe-fitting; more so than for a coal or natgas fired unit at least in the USA with the NRC inspectors popping in all the time.

Using figures in the NREL sLCOE calculator which work well for the USA, to achieve an LCOE of US$0.055/kWh reires that the total capialt costs, everything included (such as finace changes during construction), to be but US$2070/kW. I find that so low as to be not credible, even for a SMR. Doubling to US$4140/kW gives an LCOE of US$0.083 over the 30 year life of the loan; this is a credible figure for the USA provided the site has neither additional water nor transmission costs.

I’ll crudely estimate that local labour is 33% for the US$4140/kW. So using Pater Lang’s estimate of multipllying by 1.7 for the situation in Oz, I obtain US$6906/kW for an LCOE of US$0.122/kWh (which is approximately the expected USA average busbar costs for electricity in 2020 CE). I opine this is affordable.

Martin Burkle — In the USA NPP operators are well trained and amply compensated; for those reasons I doubt more operators would be required in Oz. Incidently, it takes hiring 7 people to have one always on duty 24/7/52.

David Benson and Martin Burkle:

Re: “To think that the labor component would be 1.71 times more than in the US is really hard for me to believe.”

Agreed. Thus far, I have not seen clarification of this figure in sufficient detail to eliminate the possibility that EPRI selected a high-cost nation (USA) for its base prices and then overloaded the labour rates. I’m always a little suspicious of rats in the ranks… did, perhaps, the Australian Government, when establishing the ground rules, put a thumb on the scale, perhaps two thumbs, in order to ensure that the nuclear power prices were pessimistic? Maybe, EPRI did not set this factor alone, it may well have done so in concert with a client whose published long term anti-nuclear stance led it to this outcome.

Alternatively, how much of that 1.71 is a loading for FOAK construction?

Of course, I do not know the answer to these questions. That doesn’t stop me from wanting to know, because the cost of NPP’s appears to be extortionate when compared to international examples.

This aside, well done, Peter Lang. This study is the result of considerable effort and talent.

JB,

Thank you. With your experience in project management of NSW coal and gas power stations you be the ideal person to investigate the basis of estimates and write an article to show which components are the main drivers making the projected cost of nuclear iin Australia so much higher than in Korea and UAE .

I’d suggest the first step might be to check and summarise for readers, what is stated in the EPRI reports (2010 and 2006) and also the ACIL-Tasman (2009) report. There is also an update for AEMO by WorleyParsons of the EPRI data; it investigates the sensitivity to certain parameters as you imply should be done; for example, see sensitivity to “Productivity Rate Variations”, Section 3.3.2. Unfortunately, the Worley Parsons report has excluded nuclear in its analyses, no doubt as a result of a direction from the client Also, AEMO has on its web site the spreadsheets with the inputs needed for estimating LCOE that they provided to their consultants for modelling the electricity generation cost. Here are some references (but not all):

http://www.ret.gov.au/energy/Documents/AEGTC%202010.pd

http://pandora.nla.gov.au/pan/66043/20061201-0000/www.dpmc.gov.au/umpner/docs/commissioned/EPRI_report.pdf

http://www.aemo.com.au/planning/419-0035.pdf

http://adl.brs.gov.au/data/warehouse/pe_abarebrs99014434/energy_proj.pdf (Figures f and g are taken directly from the EPRI report figures 10-13 and 10-14)

http://www.aemo.com.au/planning/0419-0017.pdf

Martin Burkle, @ 4 November 2011 at 11:34 AM,

Thank you for that link and comment. It is very helpful. If we can all explore and contribute like this we may, as a group, be able to isolate what are the main contributors causing the high cost of nuclear in the Australia.

@ 4 November 2011 at 11:46 AM,

I have a little. However, O&M is responsible for only 15% of the LCOE of nuclear (see Table A2-2), so I haven’t focused on this. The priority, I believe, is to focus on the capital cost which is responsible for 79% of LCOE.

Peter Lang, thank you for the response.

I should have noted I was considering coal outside the available options in my statement that baseload nuclear, with only CCGT would be cheaper than options that included intermittent s which, in my opinion, can only displace baseload. I’ll try to get to reading the EPRI report.

This comment is related to the breakdown of costs for CANDU’s, and I’ll have to admit to offering hyperlinks that I have not read – they were sent to me in reply to my inquiries. They may be helpful to you.

Here’s some quick background on Atomic Energy of Canada Ltd. (recently sold for next to nothing and now part of SNC-Lavalin). Most of the builds in the past 25 years were foreign and came in on time and on budget. Domestically the last reactor entered operation in 1994, which was the fourth Darlington unit. That project was stopped and started multiple times during the high interest 1980′s. Predictably the cost overruns were huge.

So my quick glance at the one document is what can go wrong domestically in politicized environments: http://www.magma.ca/~jalrober/CANcostf.htm

The second document is the, on time and budget, Qinshan post-project analysis:

http://canteach.candu.org/library/20031701.pdf

You might find some useful information for containing costs in there – although at a glance I can’t see a neat breakdown of the cost components.

Scott, thanks for the link to the IAEA lessons learned from two Candu reactors built in China. http://canteach.candu.org/library/20031701.pdf

I especially liked the chart showing man hours by month resulting in 34.000,000 man hours for two reactors. Also, the break down of hours by type of activity. At peak there were 7,000 workers on site!

The amount of concrete, 500,000 m3, is very large as compared to two AP1000s at 200,000 m3.

These projects are really large. Aren’t they?

Martin Burkle @ 4 November 2011 at 11:46 AM

Any place with civilized / restrictive labour laws is going to need five shifts, which is what my employer runs for a 24/7 chemical plant.

40hr/week X 46 wk/yr X 5 = 9,200 hrs year, vs 8,760 hrs needed

That’s with 6 weeks holiday each. The extra 88 hrs each covers sickness, training and a bit to spare for busy times, preparing plants for maintenance etc. Four shifts plus a lot of overtime works out more expensive.

Peter Lang,

All I could find was this report which includes the assumed work days for various NPP’s on page 57(according to the pdf reader)

http://www.ne.doe.gov/np2010/reports/mpr2627DoeConstructionScheduleEvaluationRev2Final.pdf

The AP1000 construction schedule is optimized for a 5 day a week 10 hour a day work schedule.

Under US work rules the AP1000 would yield 47 1/2 of paid work per week.(1/2 lunch break is unpaid and generally staggered between 11 am and 1 PM)

By US work rules it would be 40 hours base time + 7.5 hours at an overtime rate of 1.5 base pay. = 51.25 hours of pay for 47.5 hours of paid work.

An ABWR is optimized for a 5 days a week 8 hour days plus every other Saturday. In the US a standard work day is 8.5 hours minus 1/2 hour for lunch.

The ESBWR is optimized for construction with 3 crews working 4 ten hour shifts with 2 days off.

Martin Burkle, @ 3 November 2011 at 9:59 AM:

I said in my response @ 3 November 2011 at 1:18 PM the answer to your questions is “Yes, you are comparing apples with apples”. I’ve changed my mind on that. The $20.4 billion is the contract payment to the Korean consortium. Therefore, it probably does not include owner’s cost and may not include AFUDC. Therefore the Total Capital Required is probably higher than $20.4 billion.

By the way, I understand (perhaps misunderstand) the APR1400 being built in UAE is 1,350 MW (sent out) each unit, or 5,400 MW for the four units, not 5,600 MW. So the Total Plant Cost would be $3,778/kW (2010 US $).

Scott Luft @ 4 November 2011 at 12:56 AM

Your comment demonstrates why the analysis presented in the lead article is valid and useful.

This would be true if nuclear was cheaper than coal. It is not true if nuclear is more expensive than coal.