The previous Open Thread has gone past 650 comments, so it’s time for a fresh palette.

The previous Open Thread has gone past 650 comments, so it’s time for a fresh palette.

The Open Thread is a general discussion forum, where you can talk about whatever you like — there is nothing ‘off topic’ here — within reason. So get up on your soap box! The standard commenting rules of courtesy apply, and at the very least your chat should relate to the general content of this blog.

The sort of things that belong on this thread include general enquiries, soapbox philosophy, meandering trains of argument that move dynamically from one point of contention to another, and so on — as long as the comments adhere to the broad BNC themes of sustainable energy, climate change mitigation and policy, energy security, climate impacts, etc.

You can also find this thread by clicking on the Open Thread category on the cascading menu under the “Home” tab.

———————

A conversation starter: I recently delivered a talk at the Australian National University (ANU) on nuclear energy and climate change. This was the Director’s Colloquium at the Research School of Physics and Engineering (I thank the staff for being such gracious hosts). Further details about the event can be found here.

What I particularly like about this recording is that the slideshow is matched to my speech, so apart from not seeing me (who needs to?), you feel like you are actually at the lecture.

Edit: A high resolution PDF of the slideshow can be downloaded here (6 MB file)

The talk goes for about 50 minutes (plus question time). I trust you will get some useful information out of it.

Filed under: Nuclear, Open Thread

.png)

Alas, I don’t/can’t do videos. But ppt is fine.

(Comment deleted)

MODERATOR

BNC no longer posts or discusses denialism of the scientific consensus of AGW.

Following. You should have let us know you were in town!

Is there a problem with the video? The display is too grainy to read, even at the max of 480 pixel setting.

With nuclear energy expected to cost around $173/MWh in Australia http://www.ret.gov.au/energy/Documents/AEGTC%202010.pdf under a regulatory and political regime like those in the USA and Australia, nuclear will not be viable in Australia. According to this http://www.exeloncorp.com/assets/newsroom/speeches/docs/spch_Rowe_ANS_110815.pdf the CO2 price would have to reach around $100/tonne CO2 to make nuclear viable.

There is not going to be any real progress in Australia on nuclear until we are prepared to look seriously at what is making nuclear in the western democracies around 2.5 times the cost of nuclear in Korea and other Asian nations (around $5800/kW projected price in USA and Australia versus $2300/kW in Korea http://bravenewclimate.com/2011/10/11/cutting-oz-carbon-abatement-costs-np/ )

We need to analysis and find the reasons for excessively high cost, and then decide what if anything can be done to allow nuclear to be implemented in Australia at a cost similar to the cost in Korea.

The YouTube version of the video looks okay on my screen. But you can also watch it at the ANU site I linked to – it may look better there for you?

Peter Lang, on 15 October 2011 at 2:24 PM — Your costs for NPPs in the USA appears way off. The Summer Westinghouse AP-1000 justification documents give US$0.076/kWh.

As I stated on the earlier Open Thread (but it seems you refused to look at), Australia would be well advised to look to the British regulatory scheme rathr than the sclerotic USA NRC.

Finally, price is actually not the major issue as including the externalities for burning coal pushes coal far above any unbaised estimate for NPPs. The major issue is public acceptance; I opine (in a naive manner) than you’ll need about 75% voter acceptance before beinging able to move forward.

How much money do you think could be saved by ‘piggybacking’ our regulatory regime on the NRC or other regulatory bodies by only accepting already licensed designs? That way only site planning and ongoing tasks like maintenance oversight would need to be funded.

Alternatively, would it be possible to create institutions that exist outside of the political cycle and hence made immune to unnecessary ratcheting of regulations, without the problems regarding the lack of oversight?

This might require a Government-Owned, Government-Operated nuclear power company, or perhaps an extra-legal commission. Any other ideas?

Is anyone around here interested in the topic of how to get more efficient in advocating?

If so, has anyone read Dale Carnegie “How to win friends and influence people” yet?

Or any other suggestions on interesting material on that subject?

I do recall a post and discussion thread at “Decarbonize SA” on the topic “Why pro-nuclear has failed when anti-nuclear has succeeded” in July.

My fear with the Olympic Dam expansion is that piecemeal development will lock in certain configurations which could snooker desirable developments later. Recall the original specs were for 690 MWe additional power supply and 187 megalitres per day desalination. However future developments could include;

Greater capacity and transmission The suggestion of an east-west HVDC link to unify the eastern and WA grids has been dismissed as pie-in-the-sky. However the SASDO2011 report has called for increased transmission for Eyre Peninsula (west of Pt Augusta) to export its prime wind power. I assume one day when subsidies are dropped there will still be a case for x% windpower in the grid. The bigger question for SA is replacing 2 GW generation capacity now provided by Leigh Ck coal and Cooper Basin gas but both fading fast. New capacity is needed not only for OD but the State as a whole.

Regional water supply Up to 66 GL/y is now pumped from the River Murray to Pt Augusta, Woomera (70km from OD), Whyalla and Pt Lincoln. It would be good to retire that network to conserve river flow. In addition Ceduna just outside the network will grow with the zircon shipping industry and the town is looking at costly solar desal. Several prospective uranium mines near OD such as Carapateena will also need water supply. BHP are facing a PR disaster if they persist with the intended Whyalla desal which has marine conservation issues and poor salinity dispersal. Note that is still 320 km from OD. It’s not only the wrong place but may be too small.

Uranium enrichment and thorium Enrichment has been put forward as a new industry by SA Mines Minister Tom Koutsantonis. One ISL mine wants to make uranium fluoride not oxide on site. I don’t know what amounts are anticipated or whether it might use gas centrifuges or the Silex laser process. I’ll assume whatever form it takes will need tens of MW power supply. If NP is viable the question becomes whether CANDU reactors get preference or a type that needs imported enriched uranium. A related issue is thorium oxide production in association with rare earths, sources being OD tailings and the proposed Whyalla plant that will use ore railed from the NT.

Therefore before any major works are started a longer term ‘big picture’ plan should be sketched. It would be stupid to do X then a short time later say we should have done Y.

Barry,

Excellent presentation. And good answer to first question.

About half way through the presentation you discussed likely timeframe until SMR’s are commercially available. You mentioned 2025 to 2030. You also mentioned that Australia might wait and start with SMR’s. I’d suggest Australia should not try to be at the front of proving the commercial scale prototypes. We’d want to wait until the particular design we intend to adopt is proven commercially viable at commercial scale. Realistically, that might be around 2030 to 2035. So, if we are going to wait for commercially proven SMR’s we are delaying the start of nuclear in Australia until around 2030 to 2035.

I agree this time scale is likely for Australia to go nuclear given the strong public and political resistance to nuclear in Australia and the political opportunism in advocating anti-nuclear policy. We’ve lost 5 years since the UMPNE report put nuclear firmly on the table in 2006 and it was rejected by the electorate at the 2007 election. I expect the recent developments (legislating CO2 Tax and ETS) have delayed serious consideration by at least another 5 years, probably longer. The obvious reluctance to debating what are the impediments to low cost nuclear in Australia, even amongst nuclear advocates who contribute to BNC, is a clear sign of how strong the opposition is to even consider this issue.

David B Benson,

http://www.ret.gov.au/energy/Documents/AEGTC%202010.pdf

http://www.exeloncorp.com/assets/newsroom/speeches/docs/spch_Rowe_ANS_110815.pdf

Here is an interesting list of the numerous deaths, injuries, malfunctions and accidents that have been caused by or related to wind turbines over the last couple of decades.

http://www.caithnesswindfarms.co.uk/fullaccidents.pdf

Looking at this: http://www.rationaloptimist.com/blog/gas-against-wind

It would seem gas is likely to become our main source of electricity generation for quite a long time. The CO2 tax and ETS assures that gas is likely to be the direction we will take, along with continuing subsidies for renewables to give politicians nice photo opportunities. Nuclear will not be viable for a very long time – given we are not even prepared to debate what is making the authoritative estimates of its cost much more expensive in Australia than in Korea.

@ Peter Lang, on 15 October 2011 at 2:24 PM:

Have we not been through this study before? The LCOE mid-range comparison figures for nuclear and pulverised black coal plus CCS indicates a difference of about $20/MWh. this is after assuming CCS efficiency of 85% or whatever, ie carbon emission intensity of about 80kg/MWh.

To close this gap, a carbon price of $200 plus is indeed needed, so I agree with your statement of relative cost, but so what? If I take a load of solid waste to the local municipal tip the current dumping fee is $150 per tonne, and that material is not of a kind which would damage the biosphere for ever. A CO2 cost of $150 or even double that is generous by comparison.

However, considering the damage to the biosphere from CO2 emissions is only part of the difference.

I am personally at ease with suggestions that the particulate and other emissions of coal fired power are damaging the economic commons and thus that it appropriate for this damage to be reduced via a dumping fee.

Perhaps a more appropriate response, from a community acceptance point of view, is to agitate for outlawing of construction of new electrical generation capacity using technologies which do more damage to the economic commons than other available technologies.

That would show nuclear in an entirely different light.

Regarding the difference in overnight capital cost of NPP’s in USA Vs other places around the globe, we have all had this discussion before. The US clearly are way out of step with the rest of the world when it comes to nuclear plant regulation.

A public campaign to ensure that the best of comparable approval and supervision environments is appropriate and overdue. Assumptions that the US experience will be repeated in Australia are dangerous, expensive and just plain wrong when there are other examples to consider, amongst them being the British and the French. EPRI made a bad call by using US costs and excluding consideration of better alternative experience worldwide – I’m sure that this was stated on BNC about a year back.

Perhaps the government, in its wisdom, guided this decision – it is not clear from the report, which I have commenced re-reading. If so, the government was just plain wrong.

In summary:

1. $200 dollar carbon prices don’t worry me if that it what it will take to reduce global CO2 emissions. Australia cannot afford to unilaterally adopt this figure, but we must start somewhere. The current federal legislation appears to be a reasonable starting point.

2. Reported NPP overnight construction costs do appear excessive and unjustifiable in a global context. I suspect that the then Rudd Government may have influenced this decision, in order to ensure that nuclear options didn’t come out a street ahead of the peleton.

3. The much talked about difference in regulatory environments in, for example, France, Great Britain, USA and Australia are overdue for exposure, analysis and discussion, because this remains very poorly understood by the public, the majority of whom don’t appear to be aware of the comparative costs and benefits attached to this issue. $20/MWh would make a difference to the rank order of baseload power options.

Can you point us to such a study?

On Australian nuclear costs I seem to recall a high weighted cost of capital heavily inflated that cost. Federal loan guarantees or direct low interest loans could bring that right down. For example failed US solar company Solyndra got half a billion at 4.1% pa

http://abcnews.go.com/Blotter/solyndra-lowest-interest-rate/story?id=14460246

I wouldn’t speculate on the levelised cost of coal with carbon capture since I doubt it will ever happen.

If gas is the baseload fuel of the future how come the Vics aren’t taking up the offer of Federal money?

John Bennetts,

The government’s figures for the LCOE difference between pulverised coal (without CCS) and nuclar is $95/MWh not $20/MWh (see table 10-4 and 10-13 here: http://www.ret.gov.au/energy/Documents/AEGTC%202010.pdf

Forget CCS, it is a fantasy at this stage.

The remainder of your comments suggests you may have missed the whole discussion starting here:

http://bravenewclimate.com/2011/07/06/carbon-tax-australia-2011/#comment-136435

No, Peter L: I have not considered coal without CCS for years. Not that I consider CCS to be a mature technology, but that’s another issue altogether. That is why I was referring to {pulverised black coal plus CCS}. That is why I used the figures relevant to that. The reported differential is about $20/MWh. Don’t even think of vandalising my world with non-CCS comparisons or more non-CCS power stations. That implies rejection of the science relating to climate change and this is certainly not the place or the time to do such a thing.

Pulverised coal power stations have been around for more than a century. They are 1800′s technology with 1900′s control systems. There is no reason to adopt them as the base line.

This is my explanation of why we’ve lost five years so far and at least another five years, probably more.

We are clearly not ready to debate or look into why nuclear is much more expensive in the western democracies than in Korea and other Asian countries. We’re in denial.

We’ve lost 5 years since the Howard government proposed allowing nuclear power in Australia as an important way to reduce emissions at least cost. Labor ran a strong anti-nuclear campaign leading up the 2007 election and won Government.

Labor will probably remain opposed to nuclear power because they fear a large proportion of their supporters would vote Greens if Labor dumped their anti-nuclear policy.

Therefore, we are at least three elections away from when a Coalition government may be prepared to reintroduce nuclear to the electorate. And it could only do so if Labor was weak at the time or Labor dumped its anti-nuke policy.

Why three elections way. The Coalition cannot offer nuclear as a policy at the next election because Labor, with the benefits of incumbency, will run a massive scare campaign against it. There is no way the Coalition will introduce it at the next election.

The following election may have to be a double dissolution election to remove the Greens control of the senate. That election will be to get a mandate for the bills that have been put forward by the Coalition and rejected twice by the Senate. They will include repealing the CO2 Tax and ETS legislation and reinstating the border controls that this government dismantled, amongst others. So nuclear will definitely not be put forward as a policy at that election.

At the third election, if the Coalition is in a strong position, and nuclear looks like a cheaper option than gas at that time, then it may risk putting it forward. But that is probably around 2017. Who knows what will; be the situation by then.

John B, you may want to consider a non existent technology as an option but I am not doing that. You can let your beliefs run your analyisis, but that is not rational. CCS has not been proven to be economically viable at the scale that will be needed any more than geothermal, solar or wind. They are all a dream. So I do not deal with CCS at all. The options are coal (without CCS), gas (without CCS) gas and renewables, or nuclear.

According to the most recent figures for Australia, we’d need to increase the LCOE of our baseload electricity generators by around $140/MWh compared with current coal generators, $95/MWh compared with new coal (no CCS) or $76/MWh compared with new CCGT (no CCS).

Any of those cost increases are unacceptable.

I have no qualifications to argue the merits of potential base load power sources. However, every three months I get a power bill that tells me how much Carbon Dioxide I’ve put into the atmosphere. Nuclear power doesn’t do that.

Whenever I mention this to friends, they talk about Chernobyl, Three Mile Island and Fukushima. Most are resistant to facts; there is a common belief that thousands of people died in each of these events.

Personally, I’d prefer a nuclear plant in every State, honesty and no CO2…

Hi, Peter.

I did not say that CCS is proven, workable or available.

I did say that, without CCS, coal is terrible and must be penalised in accordance with the damage it does to our climate and our environment. New PF coal should be outlawed, QED. CF Bayswater B planning approval – the only technologies permitted are gas and “CCS ready Coal”, ie not coal. To weigh up anything against coal is to accept that 1900′s standards are still OK.

Demonstrably, they are not.

Generation options scenarios must exclude pulverised coal as an option. The comparison is between baseload coal (impossible, because 85+% CCS is not yet possible), gas in various ways, but with CCS (again, not possible), and nuclear, in its several forms.

The 2007-09 Labor government appears to have steered the discussion away from nuclear at competitive world prices in order to tilt the scales strongly in favour of wind and sunlight. If you favour considering base load power from fossil fuels without consideration of the unacceptable handicaps that these fuels, then you steer towards coal/oil/gas to the detriment of nuclear… ie, to argue for a carbon-impaired world and against an energy rich low carbon future. That, I will not do.

Anything further about the real differences between France, GB and USA regulation of nuclear power and the lessons for Australian regulators?

I’m at a loss to explain what happened here; http://bravenewclimate.com/2011/08/28/open-thread-18/#comment-138414

A number of times I was targeted for supposedly making unsupported claims about the performance of Areva equipment.

For some reason John Bennetts is able to imply the performance must be in the negative because “he was in the control room”, (producing no data himself, BTW), but I am not allowed say that we have a long term data set from Kimberlina (and less-so from Liddell – different generation).

The only argument can be that both are assertions. OK, I concede the point. What gives??

The strongest remark I think I have made is that the Areva/Ausra tech onsite at Kimberlina works as advertised. Areva back it, UQ will review it for Solar Dawn. I can’t offer anything further than that. Is one required to break legal agreements for commercial products to argue on BNC when that is not material to what I was saying?

I’d invite John Bennetts to email me directly (if that were possible somehow). Both Ben Heard and Barry Brook have my email address if needed.

MODERATOR

John Bennetts remark was a personal opinion on the Open Thread which is allowed on BNC without references. Your comment stated that you had a scientific data set and therefore, even on the OT, you should back that up with a link to the precise information.

An update to my comment here; http://bravenewclimate.com/2011/08/28/open-thread-18/#comment-135857 regarding the burning of 660,000ha of grass.

My office received a response from the WA Environment Minister Bill Marmion which says in part;

“The Department of Environment and Conservation calculates the greenhouse gas emissions from it’s prescribed burns at the end of each financial year … from biomass burning including methane, nitrous oxide and indirect greenhouse gases.”

then basically a list of reasons why they were doing it and then finally

“Carbon dioxide emissions are not included in the calculation as no net carbon dioxide is emitted. This is based on the assumption that an equal amount of carbon dioxide is taken out of the atmosphere through vegetation growth as is emitted through combustion in these areas.”

My question specifically asked if the relative releases of burning compared to decomposition were calculated.

(Comment deleted.)

The dangers, environmental disruption, eons long waste storage and weapons production potential brought by nuclear are a detriment to man. Nuclear energy is not a consideration in any serious effort to develop environmentally sound energy policy.

MODERATOR

BNC no longer posts comments denying the scietific consensus af AGW. To remind all readers of Barry’s position:

please stick to the comments policy as stated. Your comment re nuclear is a personal opinion and as such is allowed to stand on the Open Thread even though you supply no evidence or references.

Peter Lang, on 15 October 2011 at 2:24 PM said:

According to this http://www.exeloncorp.com/assets/newsroom/speeches/docs/spch_Rowe_ANS_110815.pdf the CO2 price would have to reach around $100/tonne CO2 to make nuclear viable.

Exelon’s generation mix is 93% nuclear.

http://www.exeloncorp.com/energy/generation/generation.aspx

Exelon operates in Illinois, New Jersey and Pennsylvania.

The population trends in those states are flat with little or no potential for growth(internal migration in the US is southward).

Nuclear is 48% of the mix in Illinois, 50% in New Jersey and 34% in Pennsylvania. http://www.americaspower.org/where-does-your-electricity-come

More nuclear in Exelon’s primary markets leaves them with the French problem…what to do with excess off peak capacity.

The cost effectiveness of any technology in any market is based on conditions in those markets. LCOE is merely a ‘starting point’. Exelon would need a $100/ton CO2 tax before they would invest in new nuclear in their markets based on their market conditions.

South Carolina Electric and Gas is building two AP1000′s with or without loan guarantee’s based on market conditions.

Same country as Exelon but with different regional load profiles

As to the broader question as to why nuclear is more expensive in Western countries I’m not sure that is the case when adjusted for wage rates. FOAK is clearly more expensive.

The Kepco quote for UAE was based on 4 units at a single site.

In the case of an AP1000 reactor a ‘one of a kind’ crane is used for assembly. There is also an on site fabrication building. Those are outlays where the cost is the same whether you are building 1 or 4 units.

I am increasingly of the opinion that facts and argument are not particularly relevant factors in electricity policy – in most jurisdictions. If the concern is to return to a rational, scientific, basis for policy, I think this is what needs to be addressed. Without this, the dollars and cents, engineering and technological questions, aren’t going anywhere.

I would avoid the same vernacular as the fortune teller/renewable seller type with a world-view that Michael Lind is not without justification in calling Green Malthusianism. http://www.salon.com/2011/01/12/lind_five_worldviews/

The language that sent me searching through my old religion and philosophy concepts is the visionary language, particularly among proponents of FiT programs – which fund technologies that are seen to be the future, despite the facts the sources have been demonstrably ineffectual in reducing overall emissions anywhere they have been implemented. Monbiot’s questioning of whether the goal is reducing emissions or building wind and solar capacity must almost universally be answered, honestly, as increasing solar and wind.

The substitution of IWTs and PV panels, for carbon reductions, necessitated Germany’s removal of nuclear capacity earlier this year – because nuclear capacity is almost universally operated as baseload and renewables don’t fit with baseload sources. It’s important to confine the cultists that ignore the facts surrounding renewables by focusing on a total energy system.

To that end, I’ll reference a recent MIT Centre for Advanced Nuclear Energy Systems article feuturing a very interesting approach to calculating storage needs under extreme (singe source) scenarios – http://canes.mit.edu/content/nuclear-energy-variable-electricity-and-liquid-fuels-production

This approach – to energy, not only electricity – seems to me more appealing. It also provides a rare vision of a largely emissions-free economy.

Conversely, Forsberg’s reference on fuel from natural gas (Shell’s Pearl plant) should serve as a reminder to those pumping more renewables backed by more natural gas capacity, that gas prices are unlikely to stay decoupled from oil prices.

Alister,

It’s good to have people point out the reactions of people in the community to mention of nuclear. You said, in your last sentence:

I would too. But only if we can have it at a cost that is competitive with coal. That is clearly not the case at the moment. It’s not even close and not likely to be for a very long time. I’ve changed my tune recently. I now recognise it is not close to being competitive for Australia, and the denial of that fact by the nuclear supporters on this web site has reinforced for me that there is no hope of us tackling the underlying problems that make it too expensive. For 2 years I’ve been trying to get people on BNC to engage in discussing and identifying the factors that are making nuclear too expensive for Australia. The next step would be to identify which of these factors could be removed, how and on what time scale. It is clear, this opens up politically divisive issues and people just don’t want to go near this. Many of the beliefs that the Left hold dear would have to be challenged. It’s too hard.

I said, I want nuclear but only if it is competitive with coal. What I mean by this is, given the best long term projections, new nuclear plants would give us electricity cheaper than coal over the life of the plant. I advocate including the externalities where there is a overall benefit to doing so. It has to be pragmatic. I do not believe CO2 Tax or ETS is an appropriate way to internalise the damage costs of CO2-e in the absence of an international agreement. As far as I am concerned the selection of the CO2 price is purely political and is totally out of balance with other even more important externalities that have to be dealt with too. I am strongly opposed to the CO2 Tax and ETS. I’ve laid out my reasons here in my submission to the “Joint Select Committee on Australia’s Clean Energy Future Legislation” here http://bravenewclimate.com/2011/07/06/carbon-tax-australia-2011/#comment-136435 and in subsequent comments.

There are two main reason why I now believe nuclear will off the political agenda for Australia for at least another five years and probably longer.

1. it is not economically viable

2. political realities

Economics: The most recent authoritative estimates of the capital cost for nuclear in Australia http://www.ret.gov.au/energy/Documents/AEGTC%202010.pdf is about $5,800/MWh. That is consistent with authoritative, impartial, figures in the USA. This shows that currently Exelon would need a CO2 price of about $100/tonne CO2 to make new nuclear viable in its region in the USA. The CO2 price needed to make new nuclear viable for Exelon has increased from about $45/t in 2008 to $100/t in 2010. The two main reasons are the price of gas has fallen considerably and projected demand growth has fallen. The development of coal seam gas in Australia will also probably give gas more advantage over nuclear than was the case in previous reports, such as the ACIL-Tasman (2009) report. It is pretty clear that nuclear will not be an economically viable option in Australia for a very long time. Perhaps not until Small Modular Reactors are proven to be commercially viable. This may be around 2030 to 2035. Until then I expect we may remain with coal and gas with some demonstration projects for solar, wind, geothermal and CCS.

Politics: nuclear cannot be offered to the community while the political parties with anti-nuclear policies have control of the Senate. The anti-nuclear parties will have control of the Senate until 2017 at the earliest unless there is a double dissolution election. If there is a double dissolution election, the anti-nuke parties may lose control of the Senate, but it will still be another three years, at least, until a major party would take a pro-nuclear proposal to the electorate. That would still be around 2017 or later The anti-nuclear parties are not likely to change their policy to pro-nuclear because anti-nuclear scaremongering is a sure election winner in Australia. Any party running an anti-nuclear scare campaign will win every time. It’s far too enticing to give up this electoral advantage.

If the NSW political landscape requires that new Hunter Valley baseload stations are either coal seam gas or CCS ready coal then they are well into the realms of fantasy. I see there is a proposal that makes it OK to drill for CSG on prime farmland if there is an ‘offset’ property just as good but undrilled

http://bigpondnews.com/articles/Environment/2011/10/16/Conservation_farming_land_could_be_mine_673831.html

Somehow this guarantees no loss of farm output which they will have to explain. Therefore we have

1st fantasy – coal will be OK if it is ‘CCS ready’

2nd fantasy – CSG doesn’t hurt farming because there are other farms.

John Bennetts,

Did you see these: If not they may help you to understand why high priced solutions will not work – they will not achieve the result you want nor will they be politically viable:

http://bravenewclimate.com/2011/10/11/cutting-oz-carbon-abatement-costs-np/#comment-138353

http://bravenewclimate.com/2011/10/11/cutting-oz-carbon-abatement-costs-np/#comment-138361

Fine, ignore the externalities associated with burning coal; I’m sure the grave diggers will appreciate the extra income.

As for small nuclear reactors (SMRs), there are two Gen III designs and two Gen IV designs currently moving towards commericialization in the USA. The smallest is the Nuscale 45 MWe unit. This should receive its NRC type license in 2018 CE; I predict several untilities in the USA will immediately begin constructing these, partly becuase of flexibility and partly becuase of assuredly lower overnight capital costs. The other is the B&W (rather larger) offereing; as TVA has expressed serious interest in acuiring about a half dozen of these units I suspect it’ll be next to receive NRC type approval.

The two Gen IV projects are in an unfortunate on-again, off-agin mode (as best as I can determine). One is the Hyperion unit which is somewhat similar to a design which the Russians will soon commercialize in larger sized offerings. The Hyperion unit will have a role to play but probably not for utility scale power. The other is the GE Hitachi PRISM about which I have no opinion regarding commercial success.

But as for pricing, it is clear that building the heavy civil components for the Westinghouse Ap-1000 in a factory in Liverpool will lower the construction cost; so much so that if these units are ever built in Australia it will still probably pay to have the heavy components constructed in Liverpool and shipped to the sites in Australia. But it is even clearer that the Nuscale unit will be have significantly lower construction cost than the Westinghouse AP-1000. Probably more expensive that the (correctly adjusted) cost of US$2250/kW for the Gen II+ CPR-1000 by quite a bit, but less than the US$3900/kW for the Westinghouse AP-1000s being built entirely on-site in the USA.

In summary, I now hold (along with DV82XL) that price is not the issue. Convincing the public is. This includes talking about the relative health risks of burning stuff versus fissioning stuff.

Peter Lang, on 16 October 2011 at 9:31 AM said:

For 2 years I’ve been trying to get people on BNC to engage in discussing and identifying the factors that are making nuclear too expensive for Australia.

#1 Regulatory risk – if there was an Australian authority they wouldn’t approve an American reactor that wasn’t approved in America – at least approved in America part seems to have been resolved

#2 Construction risk – the French reactor in Finland is badly over budget…the French claim it’s FOAK issues and the Finnnish regulator…who knows the truth…until one is built on budget no one is going to buy one…The AP1000 hasn’t been built in a Western country..it’s too early to tell if the ‘sales brochure’ of ‘on time, on budget’ construction for the AP1000 is just ‘salesmen talk’ or reality

#3 Demand Risk – Has to be able to compete on price to guarantee it can sell 90% of it’s power at a profit.

All three risks affect financing rates…financing rates effect the price that one has to charge for electricity which effects demand risk.

Here is the actual budget for VC Summer #2 and #3. They’ve sunk $1 billion so far and they are mostly ‘on time and on budget’.

http://www.scana.com/NR/rdonlyres/A830A131-9425-46F1-B948-C8424530EE49/0/2011Q2BLRAReport.pdf

It was an excellent presentation. Barry is a very good speaker.

I liked the plot of the build out in France nuclear. Totally a great investment and I am glad they were smart enough not to change directions.

My hope is that the Chinese will get smart right up front ( they probably are already) and do tons of nukes since they do them for around half or more below US price. It is the best way and the Chinese govnmnt can do it..

GSB

The Westinghouse AP-1000s under construction in China are on time and slightly under budget according to the press releases reworked by World Nuclear News. The version of the AP-1000 for the four almost-under-construction (the contract for the transformers has been let) in the USA has a slightly more expensive civil structure component (at NRC demand) but that should not effect the construction schedule.

@ Peter Lang, on 16 October 2011 at 10:05 AM:

Yes, I saw, read and digested the referenced comments and the paper to which they refer.

If, as appears very probable, regulatory issues are making one technology more expensive that it should be wrt other technologies and nations, then we are probably in agreement that these must be highlighted in a way that will help our political masters to avoid falling into the high cost trap and adopt the lower compliance costs of other comparable countries, whilst still achieving satisfactory physical, financial and social outcomes in matters such as land use planning, plant safety, community safety, community health, environmental impact, national security, security of supply, external costs (eg transmission systems), fair scheduling of individual generating units and technologies, firness of tariffs, including feed-in tarrifs, existence and effects of REC’s and similar, costs passed to other generators, equity and magnitude of government subsidies, if any… the list is considerable.

Hence my interest in France and the UK and perhaps other western nations’ nuclear regulatory regimes within the broader perspective of their national energy market.

I have seen assertions and broad comparisons. I wonder whether there is, out there somewhere, more specific analysis of just what has worked best and what has not. If our politicians are unaware of what best practice regulation looks like, how can they possibly achieve an optimal outcome? Has AEMO, for example, produced anything of value here?

Harrywr2,

It’s good to see someone make at least an opening comment on this long avoided issue.

However, it needs much more than an opening, high level comment. It needs in depth discussions to identify the actual factors, what is their impact, which could be addressed, how could they be rectified, what is the priority order, and how long would it take.

If you are serious, and some others also want to get into this issue, then perhaps you and others could suggest to Barry there is enough interest to run a separate thread on this issue.

I’ve made many comments on this in the past, but they have generally drawn little or no response. Largely they’ve been ignored or there has been some sort of high-level motherhood statement. But no attempt to take a serious look into this.

I’ve summarised some of my previous comments, and included links to some of the most significant earlier comments, here:

http://bravenewclimate.com/2011/07/06/carbon-tax-australia-2011/#comment-136436

I’d urge you and others too look at that if you are genuinely interested in following through on this.

Barry, I can listen to the presentation, but like others, more than a few of the slides are unreadable … where ever I try … utube, Uni, BNC … full screen, 480p. Can you please post them?

The Mojave solar project is a conjunction of the best solar resource on the planet, good proximity to demand centres, a solar resource that correlates reasonably well with the load, access to important lessons from previous projects, and a Californian 20% renewable energy target, or in other words, to quote from Top Gun “It doesn’t get any better than this Maverick”. It recently received a $1.2B loan guarantee. The renewable energy power purchase agreement between PG&E and Mojave Solar remains confidential.

Total cost US$1.6 B

Capacity 250 MW (no storage)

Cost US$ 6,400/kW (compare around $665 to $1,000/kW for obvious competitor – GT)

Capacity factor 28%

Jobs created 900 ($1.8M per job)

http://www.pge.com/nots/rates/tariffs/tm2/pdf/ELEC_3876-E.pdf

http://www.huffingtonpost.com/2011/09/15/mojave-solar-12-billion-loan-guarantee_n_965397.html

http://www.eia.gov/oiaf/beck_plantcosts/

But despite the conjunction of ideal circumstances, the California Public Utilities Commission stated

http://docs.cpuc.ca.gov/PUBLISHED/COMMENT_RESOLUTION/145204.htm

The Mojave project highlights both the strengths of solar thermal in locations where it is best suited and going to have its best chance of success, to the harsh reality that no matter how hard you try, there is never going to be a cheap way to install hundreds of thousands of mirrors (or millions) over 1,765 acres, with an energy source that is only available a quarter of the time.

Only 496 signatures on the petition with less than two weeks left. Not looking good. At this rate, only about a thousand will have signed by the deadline.

[nonsense regarding Fukushima and Tokyo deleted]

@ George,

Do you have a reference regarding Fukushima and Tokyo?

[Ed: no he doesn’t and can’t because it’s errant nonsense – his statement was deleted]

It’s hard to see gigawatts of baseload based on CSG in NSW

http://www.abc.net.au/news/2011-10-16/csg-protests-around-the-nation/3573792

I’d guess CSG will also be necessary for all the ‘green’ buildings to be based on tri-gen in the Sydney CBD. What’s the alternative? The clip doesn’t show it but I imagine the crowd chanting

whaddawe want?…So-lah

Let’s work on this a little more. Three sources: NREL and BLM fact sheets, and Marketwatch news story. 830 temporary construction jobs for a period of some 1.5 years is 1200 construction job years (as reported by NREL). Project will also create 80 annual O&M jobs and has a power purchase agreement for 25 years (so that’s another 2000 job years). Lastly, project will also create “over a thousand direct and indirect service and manufacturing jobs throughout the supply chain that will span the country” (for another 1500 direct and indirect construction job years at the low end). Using total capital expense for the project ($1.6 billion), that comes to some $340,000/job (or $500,000/job if we exclude direct and indirect supply chain). I went looking for Office of Management and Budget (OMB) scorecard for the loan guarantee, but could find none in a quick search. OMB is an independent agency within the US Gov, and would provide a full accounting of projected job creation, cost breakdown, capital expenses, operation of plant and contribution to local tax base, and stuff like that.

This appears to be on par for what I get for Calvert Cliffs (doing a rough approximation). $9.6 billion for 1,600 MW power plant ($6,000/kW capital cost), 4,000 short lived construction jobs (no accounting for job years provided), 360 permanent jobs (at 14,400 job years), or roughly $522,000/job (excluding supply chain jobs). Anybody else have a better source for nuclear and projected cost of job creation?

EL, agree that the figure for “cost per job” is a grey area my back-of-the-envelope figure was simply to imply that despite such a large investment, so few jobs would be created. But the point more generally is to what extent expensive, low-intensity, energy reduces productivity, thereby destroying jobs, in which cheaper, more effective alternatives exist.

http://www.aei.org/docLib/EEO-2011-02-No-2-updated-g.pdf

In other words, for the same money, why couldn’t California employ 5000 people to dig, then re-fill holes for 10 years on a wage of $30K, and wouldn’t this also create employment? What would the net benefit be to Californian by investing in the Mojave plant relative to installing the most cost-effective technology available, and is this investment really the optimum use of a scarce resource? How does this compare with R&D investment etc?

EL, agree that the question of “how much employment does a nuclear build create?” is an interesting question, but perhaps misses the point. We don’t build a power station to create some jobs in construction, but to produce an essential commodity that permits society to function, and to hopefully sell the product into a market at sufficient profit to stay in business.

Barry, if a link to your transcript was added to the post, we could read what you said without having to bother with the images at all.

The latest weasel word appears to be ‘biobanking’ when you politely refrain from drilling or mining good farmland to leave some for later. Perhaps we should wait for ‘exobanking’ so if Earth’s CO2 gets too high but some other planet reduces CO2 all will be well. If Australia truly had 180 years of coal left surely they wouldn’t need to dig up or drill prime farmland as there would be plenty of other sites. Therefore I think coal could get expensive with or without carbon tax. That may gazump those other weasel words ‘carbon capture ready’.

On gas for future baseload or to shadow mandated subsidised wind power I suspect really only WA and Qld have the long term gas supply. Both States appear hellbent on selling it overseas. Absent new pipelines I wonder if LNG tanker ships could sail around the coastline to deliver gas to Australian coastal cities in competition with Japan for example. Can’t happen? I wonder if that is another reason for Adelaide’s Torrens Island station building cryogenic storage tanks.

Sadly, what I said about Tokyo is true. Many have already evacuated, to other parts of Asia, such as Vietnam. Northern parts of the city have higher radiation levels than Chernobyl evacuation zones:

http://blog.alexanderhiggins.com/2011/09/19/experts-warn-fukushima-worse-chernobyl-tokyo-evacuation-longer-ingored-68881/

Not that this means we shouldn’t pursue IFRs, which don’t rely upon diesel for cooling. If IFRs were used, none of this would have happened. It boggles the mind that LWRs are still the design most commonly proposed, especially since there isn’t enough uranium for those reactors, with Megatons to Megawatts ending in 2013. This is LWR “lock-in,” like how we still use the qwerty keyboard to type. The qwerty board was invented by the typewriter’s inventor to purposefully be as difficult to type with as possible to avoid keyboard jamming. However, because this is the type we learned, we may be stuck with this keyboard forever! LWR was developed first for naval propulsion because of its compactness, and now LWR “lock in” will be difficult to avoid. Maybe we should just totally give up on LWR.

I have added a link to a PDF of the slides in high rez in the post above: http://bravenewclimate.files.wordpress.com/2011/10/bwb_anu_np.pdf

There is no transcript.

Maybe the foot in the door is to align yourselves w/ the company that is putting in the Uranium mine.

Barry Brook, on 17 October 2011 at 9:42 AM — Good slides; most clear.

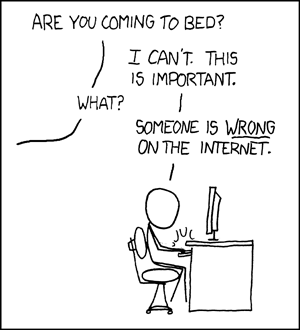

“George”, your link to that blog of anti-nuclear activist Alexander Higgins is hardly reliable. Do you have a link to a reputable analysis (e.g. from NISA or IAEA), or evidence that anyone in Tokyo is taking this seriously? I’d strongly encourage you to be more critical in your evaluation of your sources — remember this classic xkcd cartoon:

Most things you find on the internet are… wrong.

Any thoughts on this?

http://bravenewclimate.com/2011/10/15/open-thread-19/#comment-138581

Also, with regard to demand risk I would suggest that people look at the demand pattern in a place with a very large baseload proportion like Victoria (due to the Latrobe Valley power stations).

From the look of daily demand data from AEMO (source: http://wwww.aemo.com.au/data/price_demand.html ) you could easily integrate about 5 GW of baseload nuclear power into the Victorian section of the NEM grid without significant problems (siting and transmission requirements excluded), possibly another 3 GW more if there were appropriate off-peak storage system built and load-following built into the plants. That’s a lot of displaced coal.

If you built two dual-reactor AP-1000 plants at the same time you could replace Hazelwood, Yallourn and Loy-Yang A. That cost is about $10-$15 Billion for the plants themselves.

My question is this: How much solar power at today’s prices could be built for that cost in terms of average output? Answer should be in terms of capacity factor * peak output if possible.

Harrywr2 @ 16 October 2011 at 10:26 AM

Thank you for this link to the budget and June 2011 progress report for the VC Summer #2 and #3. http://www.scana.com/NR/rdonlyres/A830A131-9425-46F1-B948-C8424530EE49/0/2011Q2BLRAReport.pdf . I did read it when you posted it; apologies for not saying so at the time.

It is an interesting status report. Following are my comments:

1. EPRI (2010) http://www.ret.gov.au/energy/Documents/AEGTC%202010.pdf estimates the Total Plant Cost would be $5,742/kW (in 2009 AUD$/kW sent out) for new nuclear in Australia. The estimating assumptions are in Section 4. For comparison, the VC Summer #2 and #3 budget in the link you provided is US$5,371 for 2,200 MW, or $2,441/kW (in 2011 USD). What is the reason for the large difference? I’d suggest we need to understand what is causing this difference. The EPRI figures are what the Australian government is using. If we think they are wrong, we’d need to be able to demonstrate what is wrong with EPRI’s assumptions.

2. This says: http://nuclearfissionary.com/2011/01/31/new-nuclear-construction-v-c-summer-2-3/ “The combined priced tag for the project is $9.8 billion.”. What does this figure include that the $5.371 billion figure does not? Which is the correct figure to compare withy the EPRI projection for Australia and why? (The $9.8 billion is $4,455/kW.)

3. Appendix 1 says “Based on April 1, 2009 Performance Measurement Baseline Schedule”. This is a give way the project is using Earned Value Management (EVM) (or Earned Value Performance Measurement (EVPM)) method for reporting project status, project performance and Estimate at Completion. The EVPM method maximise the probability of bringing large projects in on budget and schedule and of minimising cost blowouts. It is interesting and revealing that Australia’s largest public funded project, the $50 billion National Broadband Network (NBN) (now projected to be $78 billion), is not required to use EVPM.

Will there are no signs Victoria is considering any large scale generation except brown coal. The Morwell MW gasified brown coal + natgas hybrid plant won’t replace any large units. If I recall Hazelwood is due to retire in 2031 but amazingly the owners accept that it is a dinosaur. The Federal fund for converting 2000 MW of brown coal to something else seems to have only one taker far and that’s the small Playford plant in SA to be replaced by a solar boost system to the newer coal plant next door.

Carbon tax should add about 1.35 X 2.3 = 3.1c per kwh to Victorian power bills. I wonder if the plan is to chuck a wobbly this time next year about the hardship on working families and get some kind of reprieve, eg to NSW black coal levels of tax . Loy Yang A is also the land node for the Basslink cable which aims to ‘drought proof’ Tasmania through dry spells. If Vic gas isn’t plentiful enough to replace coal the politically expedient approach would be to keep burning brown coal with a partial carbon tax exemption. That way a decision on brown coal replacement can be postponed for a decade. I’d almost bet on it.

John Newlands:

To say that Hazelwood is due to retire in 2031 is to torture the meaning of the phrase “due to retire”.

Constructed in the 1960′s and designed for a life of 25 years, it has had more life extensions than enough. It is now comparable to a human being approaching his 140th birthday after several lots of open heart surgery, with new hips, eyes and knees, blind and deaf, requiring daily dialysis and more, saying that he must have his driver’s licence re-issued, because he isn’t due to retire for another decade.

Piffle.

It’s long past time for the old dear to be put out of its misery. Posturing about the lost value of a couple of decades’ imaginary generation at Hazelwood is just window-dressing by owners seeking an extortionate price.

Peter Lang, on 17 October 2011 at 12:28 PM — My understanding (such as it is) is that US$4455/kW buys one all the planning and permitting costs, plus the interest forward to NPP completion for that, all the site purchase and preparation costs, plus the interest forward to NPP completion for that, plus actual construction costs, plus the interest forward to NPP completion on that. So these various financing costs of engineering planning, permitting and site prepartion (ppp), instead of being expensed against current operations, end up boosting the eventual cost of the NPP quite a bit. Not all state utility commissions in the USA require this form of bookkeeping; some allow ‘reasonable’ ppp costs against current revenues. I hope I’ve said that properly and clearly, not being well versed in these matters yet.

It’s pretty obvious that the plans are for the Latrobe Valley to convert to IDGC possibly with CCS, which in all likelihood will simply be a politically astute way of burning gas whilst subsidising the Latrobe Valley.

Hazelwood will probably go on the Australian Government’s conversion list along with Playford in all likelihood. The HRL prototype plant is up in the air due to funding concerns. If that doesn’t go ahead then they’ll probably build a CCGT plant to partially replace Hazelwood and put in a bit more wind power to ‘green’ it up a bit.

However, if someone with some vision and common sense came along with a plan then I would suggest that Victoria is one of the better suited states for nuclear power due to its existing large baseload capacity and hence relative ease of conversion.

The future looks bright for the IFR, simply because there is no alternative. New data coming out for 2011 really makes the alternatives of the past, coal and gas, look pretty bleak. “Shale gas” has received loads of hype, but has an EROEI and flow rate lower than tar sands. According to Canada’s top geologist, “there may be 100 years of methane, but it may take 800 years to produce.” Shale gas can’t even cancel out declines in conventional gas much longer, declines that are about to excellerate. As for coal, a new study suggests peak coal could be this year, 2011. Already, demand for coal is outstripping supply around the world.

http://www.energybulletin.net/stories/2011-05-17/debunking-shale-gale

http://www.energybulletin.net/stories/2011-05-13/peak-coal-year

I have been doing some research on fusion lately, and it would appear that the biggest problem is that it releases its energy as neutrons. In a commercial deuterium tritium fusion plant like ITER, they will have to tear apart the insides of the reactor every few months due to neutron damage, then build them back up again- there’s no possible way to do this at an acceptable cost. Does anyone here see any way out of the neutron problem, or more promise for other forms of fusion, such as deuterium deuterium or deuterium 3He?

Zachary Moitoza, on 17 October 2011 at 1:50 PM — That Peak Coal This Year was quite surprising. {Hope that proves to be correct…}

Will I agree CCGT is a stopgap measure for Vic looking at reserves to production in Table 3.1 of this report

http://www.accc.gov.au/content/item.phtml?itemId=961581&nodeId=a934a0311336f67b0f7303f344579f82&fn=Chapter%203%20Natural%20gas.pdf

for the Gippsland, Otway and Bass basins. However that production is not yet serving much baseload. Vic gas is also piped under Bass Strait to Tasmania’s two gas fired power stations and other users.

I understand CCGT plant can last 40 years. Unless Vic can get

1) coal seam gas piped from Qld or NSW

2) WA LNG shipped around the coastline

3) local gas discoveries perhaps aided by fracking

a new gas plant would have to close early, say by 2025 at the latest. At least Vic has plentiful developed coal (unlike SA) so CCS could be their stalling tactic if the Feds play along with it..

John Newlands, on 17 October 2011 at 2:23 PM — CCGT vendors state a design life of 40 years. However, nobody knows how long any CCGT will last, which depends in part in how it is operated. Nonetheless, I opine most will last in excess of 40 years.

DN and DBB: Have you ever looked through innards of a 40-year old boiler? Or a 30-year old GT? I have no doubt that a 40-year design life is possible, provided that operation was either at a 5 or 10% capacity factor or a steady 80%, which would be prohibitively expensive from a fuel perspective.

That leaves the high capital route of peaking plant and 10% capacity factors.

In between, the GT would literally crack up and the boiler side of things would need new headers and other really serious stuff inside 40. Besides which, the steam turbines used either daily or full time would be pretty close to stuffed by their 25th birthday unless somebody has really pulled creep and cracking into line.

Electrical and control systems will look decidedly ratty at 40 years if not fully replaced earlier, as also some other auxillaries such as fans and pumps.

Like my old power station, I suggest that a 40-year old CCGT is certain to have a lot in common with Grandfather’s Axe: Three new handles and two new heads and still going strong.

Frédéric Bastiat “broken window” fallacy assumes that spending a dollar in any instrance is always the same, and says nothing about what happens to that dollar once it leaves the shopkeeper’s hands. He understands the “invisible hand” of the marketplace (a la Adam Smith), but not the tableau économique of François Quesnay (on the multiplier effect). Who’s to say whether the shopkeeper spending his money, or the glazier (once payment for the window has been received) makes the most rational choice of what to do next with that legal tender (where it can do the greatest amount of work)? In fact, in traditional liberal economics (even of the British variety), it’s enough just to move that money around (to wrest it away from the stranglehold of the penny pinching and miserly shopkeeper), and put it into the hands of the laborer where it can do some work (and conduct a great deal of commerce). Digging holes and moving money around is exactly what we want to do to re-start an ailing economy (and it doesn’t matter the cost). Hence the “famous” digging holes analogy of Keyenes: “Just as wars have been the only form of large-scale loan expenditure which statesmen have thought justifiable, so gold-mining is the only pretext for digging holes in the ground which has recommended itself to bankers as sound finance; and each of these activities has played its part in progress — failing something better” (Ch 10, “General Theory of Employment, Interest, and Money: The Marginal Propensity to Consume and the Multiplier”).

So what does this mean for energy development and green jobs. I suppose we could write a whole book about it (and provide a trenchant look at French and British political economy in the process). But since nobody wants to do that (and nobody would read it here anyway), I’ll simply say in shorter form it has something to do with creating new markets for commerce, trade, and goods (all the stuff that jobs are made from). Spending is awfully good, whether it’s the shopkeeper who does it or the glazier (in this, I think even Bastiat would agree). But what we are truly after is the “something better,” and in this we’re interested in consumption and the multiplier (or creating markets where private actors will be willing to invest and take risks, to make a return on their investment by meeting consumer demand, and both with or without public incentives as a significant measure of personal freedom and liberty). Only then will digging holes or fighting wars become any less enticing as a pathway for economic growth and stimulus (and the shopkeeper can sit back and relax and not have to worry about broken windows in the first place). The glazier (who has an interest in repairing windows) has plenty of work to keep him or her busy building new offices and residence once private markets get rolling again. And if ever another recession were begin, my recommendation to the shopkeeper would be … get some “broken window” insurance (and not less work for the glazier)!

El:

Ever thought of using paragraphs?

A dense block of text is… well… dense.

The multiplier effect is irrelevant to your argument – the point is that money can be spent productively or it can be wasted on a broken window.

Once spent, both dollars are equivalent in terms of multiplier effect, unless you pretend to know the difference in spending habits between shopkeeper and glazier in very great detail. This then would become a discussion about the shopkeeper or the glazier as individuals, not as members of a community.

There is simply no good reason to assume that a magical multiplier effect will restore not only the value of the dollar but also add further value, thus making window-smashing a worthy profession.

To claim, as you appear to be doing, that JM Keynes would advocate “moving money around” or throwing money at makework schemes under all situations is simply not correct. Re-read your references and you will find that even Keynes only favours this under specific circumstances, ie those when insufficient money is in circulation. This is what the Americans called Quantitative Easing recently as the Fed tried unsuccessfully to coax a bit of growth into the economy.

In times of oversupply of money, eynes would certainly not have advocated what you are defending, because this is the road to inflation and destruction of wealth.

Bastiat was quite correct to counsel against wasting money, and the example cited by Graham Palmer is also quite correct.

I offer a further illustration of what is happening. Forget money and think value, which is the term I shall use where perhaps an economist might use the term “utility”.

The value of the window is not enhanced by smashing it.

The value of a MWh of power generated in one way is not, of itself, greater than the value of a MWh of power generated in any other way.

If Company A chooses to use expensive power sources, it will have higher input costs than Company B which takes the best that the market can offer.

This leaves Company A with less with which to its workers, who thus either work for lower pay or risk losing their jobs entirely when Company B puts Company A out of business.

This is what Graham Palmer’s reference shows is happening. There is no argument that can justify additional input costs in the way that you have attempted to claim.

There is, however, room for argument about externalities, which might take the form of a carbon tax (for example), designed to avoid reduce the damaging behaviour of those who would otherwise cause demonstrable damage to the economic commons of society by free-loading off our commonly owned and shared resources such as clean air and water, liveable environment and so forth.

There is value in avoiding damage to the commons.

There is no value in simply tossing money at expensive items when cheaper comparable items of similar utility are available.

This is Economics 101 as I first studied it and as I revisited it 30 years later in the 1990′s. I’m sure that it hasn’t changed since then. Real economists may take over from this point.

@Zachary pointed to some “Peak Coal!” literature, which includes – “the world will finish off the coal that is easy to reach and high-quality”.

True blue believers in the renewables movement have a basic tenet of faith that the world’s resources are gunna run out. Then, only those people who have been virtuous enough to install renewables equipment will survive. And in the process, escape judgement for their emissions.

When you consider that with enough energy and ingenuity the rock under your feet today will become the car that you drive tomorrow, it’s pretty clear that their predictions of the end of the world are not based on fact.

Typically the renewables salesmen use weasel words like “cheap” or “published reserves” or “accessible”. When you analyse their English, their purportedly technical statements amount to saying the equivalent of “tomorrow’s demand cannot continue to be met with yesterday’s technology/infrastructure”. And of course it can’t. There is an essential difference between something labelled as yesterday’s or tomorrow’s: in the meantime we have worked hard to make sure it is different.

If we are to connect with environmental conscience among our listeners, we couldn’t do better than to persuade them that it isn’t the resources that are the problem, it’s the wastes that industry converts them into. The most destructive waste that we continue to create is a gas. Need I go on?

If someone wanted to make a buck out of growing public fear, he or she could probably make a comfortable income selling windmills, or prayer wheels and shouting about “Peak Resources!”. It wouldn’t make much difference to their emissions, just that they wouldn’t feel so guilty about it.

Hi all,

I like this website because I feel at home. That is, we are all here for the same thing- the future of our energy. However, an alien looking from the outside would be fooled into thinking we are very stuck in our ways and tend to blindly accept, or outright reject certain technologies.

This to a certain extent I would say is true, but if only they looked outside at what we have to deal with from lobbyists (of all persuasions), political activists and the general laymen community, they would have a much more positive view of bravenewclimate.com.

Our future energy mix, no doubt, will be a mixture of a variety of technologies. And, research into energy will continue just lke every year since the begininning of the industrial revolution.

My field of research is renewable energy (photovoltaics). I’ve put up with plenty of illogical criticism in the past, and some quite warranted. But this, i believe, is nothing compared to what nuclear advocates will have to deal with in future, the amount of negative emotion able to be conjured up by simply mentioning the word ‘nuclear’ is often extraordinary. Nuclear (in particular IFR’s) should be given rational consideration in our future energy mix, but this won’t happen if we do not address the general public’s perception of nuclear- or more importantly- the difference of new techs like IFR’s have compared with Gen I & II.

Nuclear waste, weapons proliferation, meltdowns and accidents are the most common thing to spring to mind to many in the general community. It seems such a tragedy if by addressing those issues with new technology, mentioning only one word (‘nuclear’) makes it all a waste of time.

Roger Clifton, John Bennetts, bravo, excellent points. Paul Moonie, you also make some great points, and I wish more people would look at the issue this way.

JB @6.39 – well stated, thanks.

I have a question regarding energy crops, and I suppose this is a good place to ask:

Food shortages in many regions of the world are not a result of humanity having exceeded the “carriage capacity” of the planet but unequal distribution. With less food wastage in the developed world, more efficient distribution and the introduction of industrial-scale agriculture in the developing world, the planet can easily sustain 9-10 Billion people. That’s the consensus.

Now what about energy crops? It is often claimed that energy crops replace food crops, leading to food shortages in poor countries. What is the magnitude of that problem today?

And how much of the world’s arable land could in theory be dedicated to growing energy crops without risking food shortages?

Max, you have indeed come to the right place.

I am sure that you and I will learn from those who respond. First, please recognise that there are very heavy costs associated with moving things around. Foods are an example.

Some people make a distinction between those foods that are human dietary components and other organic/straw products.

Please do not think that this is rude, but are you considering the protein/food portion of your agricultural yield, or the cellulose fraction?

Protein is available, more or less, as food to humans.

Cellulose is food for termites and animals with several stomachs, and who probably expell large volumes of methane, which is itself a bit of a worry from a climate change point of view.

So, consider what your target issue is: is it corn (eg starch) or the husks (eg cellulose)?

Both contain energy. The question is: can humans digest the form of energy that you are interested in? Please return here and discuss this further.

@Peter Lang, on 17 October 2011 at 12:28 PM said:

EPRI (2010) http://www.ret.gov.au/energy/Documents/AEGTC%202010.pdf estimates the Total Plant Cost would be $5,742/kW (in 2009 AUD$/kW sent out) for new nuclear in Australia. The estimating assumptions are in Section 4. For comparison, the VC Summer #2 and #3 budget in the link you provided is US$5,371 for 2,200 MW, or $2,441/kW (in 2011 USD). What is the reason for the large difference?

The $5.371 billion cost(actual dollars when spent) for VC Summer #2 and #3 are PER UNIT.

$4.3 billion constant 2007 US dollars + estimated inflation of $1.1 billion. The bulk of the construction financing costs at VC Summer are being passed thru to current electric rate payers and aren’t being capitalized. SCE&G is a regulated utility. The rates they are allowed to charge for electricity allows for a fixed return on investment.

If I understood the EPRI report correctly they used constant 2009 Australian dollars(no allowance for inflation) but they capitalized construction costs at 8.5% interest.

Harrywr2,

Why do you say that cost is fore one unit? The report titles says “Units 2 and 3″ and the tiles on Appendicies 2 and 3 say they are for units 2 and 3 and the times period is through to completion of untis 3. Appendix 1 shoes all the milestones for the project and they are for Units 2 and 3.

You are correct the EPRI figures are in 2009 A$ and WACC is 8.4% (before tax).

Comparing the EPRI report and the VC Summers status report explains some of the reasoons capital cost differences.

The Australian capital cost figure is higher because the Australian figure is for a greenfield site whereas VC Summers is a brownfield site.

Furthermore, Australian labour costs are higher and productivity lower; the factor is 1.71.

There is also an exchange rate conversion factor, USD = A$1.23.

This goes some way to explain why nuclear will be higher cost in Australia than in USA even if we could remove many of the impediments to low cost nuclear.

And nuclear in USA and Australia will be higher cost than in Korea for a number of reasons, especially investor risk premium.

@Roger Clifton, on 17 October 2011 at 6:52 PM said:

If someone wanted to make a buck out of growing public fear, he or she could probably make a comfortable income selling windmills, or prayer wheels and shouting about “Peak Resources!”

Investments in electricity generating technology tend to be long term with relatively slow payback periods. A purely selfish choice involves deciding whether I am going to pay interest to a banker for a technology that has little or no future fuel cost or am I going to minimize what I have to pay to the bank for interest and pay whatever I have to pay for future fuel costs. Whichever choice I make I’m going to be stuck with my decision for 30 to 40 years.

The banker tells me he will give me a fixed rate on the interest.

The coal miner tells me he doesn’t know what his future costs will be.

So I need to make a decision based on what I believe the future cost of coal mining will be.

I can use many guides…historical price trends etc to make an estimate.

In the US at least the numbers that are most troubling are

1) The number of tons per hour a coal miner can extract has dropped from over 4 to less then 3 in a decade East of the Mississippi.

(Wyoming coal miners are doing nicely at 29 tons per hour but even that is a substantial drop from 44 tons per hour)

2) Coal surface transportation rates have been trending up for a decade.

The US is the worlds second largest coal producer and the productivity trends are headed in the wrong direction. Wyoming coal is still inexpensive but it is 1,500km from the nearest ship/population center.

US Annual Coal report 2001

http://www.eia.gov/FTPROOT/coal/05842001.pdf

US Mine productivity 2009

http://www.eia.gov/cneaf/coal/page/acr/table21.pdf

Peter Lang, on 17 October 2011 at 10:39 PM said:

Harrywr2-Why do you say that cost is fore one unit?

Actually…I’m a bit mistaken…the costs are for SCE&G’s 55% share of the total project…so a bit more then 1 unit.

http://www.bizjournals.com/charlotte/print-edition/2011/09/16/sc-nuclear-plants-projected-price.html

Chief Operating Officer Steve Byrne told the S.C. Public Service Commission that the “future-dollar” cost of SCE&G’s 55% share of the project is now projected at $5.6 billion. That works out to atotal project cost of $10.2 billion. When regulators approved the expansion, the estimated final cost was almost $11.5 billion

Inflation hasn’t been as high as was expected..so that dropped quite a bit off the ‘final cost’.

As far as investor ‘risk premiums’, a couple of sets of reactors built on time and on budget decreases two of the three risks(regulatory and construction cost). All that is left is ‘demand’ risk.

In the US Southeast the delivered price of steam coal is over $90/ton and they have no usable wind(Hurricanes don’t count as usable). The only real demand risk is from ‘shale gas’.

PL &Harrywr2,

great discussion on costs.

Why are these companies borrowing the money for these plants?? Makes no sense and has a huge cost implication. somewhat akin to running out and financing a new car. Why don’t these utilities start socking the money away way in advance??

So VC summers plants are approx 4500$/kw. but the real number needed is $/kwh over the life of the plant and that’s the advantage of Nukes….asked in another way what is going to happen to the SC customers projected cents/kwh they pay on their monthly bill??

GeorgeS, I do’t know about SC, but there are many regulators that won’t allow a project to be part of a customer’s bill until complete – here’s an article touching on this from Florida: http://www.palmbeachpost.com/money/1881084.html

This is the type of issue I tried to touch on earlier: The costs are never agreed upon. In my jurisdiction, Ontario, costs are still hotly debated and the last new reactor to come online was in 1994! The debates are over the value of loan guarantees, financing costs, contracts guaranteeing the sell of production, insurance, long-term disposal costs….

So while I clearly see a benefit of discussing ways to control costs, I’d have no expectation on unanimity on any estimate, or even an estimated range.

I also think the cost of innovative units, such as the SMR’s and waste-fueled reactors isn’t overly relevant in the FOAK stage. What Ontario, or Australia, does is far more important in terms of a story that can be replicated, than in terms of the cost to themselves at the FOAK stage — and I think any effort to close the fuel cycle carries the promise of payback that a cheaper unit may not. One such payback is the opportunity for cheap output in the future that will power the currently impoverished parts of the world, and prevent the Indias and Chinas of tomorrow from adding to emissions.

I will also once more note a publication that is anti-nuclear, that gives another common argument on costs (specifically of the UAE decision):

European regulators also now require plant designs to include a “core catcher” that would catch the molten fuel (corium) if it breached the reactor’s pressure vessel in the event of a failure of the emergency cooling system. When AREVA failed to win the UAE tender,Lauvergeon

claimed that the reason that the proposed EPR was 15 percent more expensive than a Gen II PWR was because of costlier safety enhancements—such as the core catcher and the reinforced containment—that were designed to prevent offsite radiological impact. Buying the Korean APR1400, she said, was like buying “a car without air bags and safety belts.”

-page 27 of http://probeinternational.org/library/wp-content/uploads/2011/05/WorldNuclearIndustryStatusReport2010-2011-V3.pdf

I note that partly because the unsubstantiated post on this thread earlier (since removed) played directly to the ‘core catcher’ safety spin in this quote.

Sorry to pop out of nowhere with this, but it’s the Open Thread…

Can those here familiar with Diesendorf (2010) The Base Load Fallacy and other Fallacies disseminated by Renewable Energy Deniers point me to a good critique?

The paper (small pdf) is available here:

http://www.energyscience.org.au/BP16%20BaseLoad.pdf

GeorgeS, on 18 October 2011 at 2:58 AM said:

.asked in another way what is going to happen to the SC customers projected cents/kwh they pay on their monthly bill??

It’ll go from an average 8.3 cents to 11.4 cents/KWh in 2020 assuming fossil fuel costs for their remaining generating equipment doesn’t increase at least according to this 210 page document filed in 2008 with the S C Regulators –

http://dms.psc.sc.gov/pdf/matters/3B3E3E6F-F48A-A3C5-50C13F96CFDBA604.pdf

Appendix H goes thru all the various alternatives that were looked at and the underlying assumptions. Considering the decision point was 2008 their assumptions relating to gas prices were valid but probably not so valid in hindsight…but then we don’t know what gas prices are going to be in 2020 which was part of their decision making matrix…diversity of fuel mix in order to avoid ‘market volatility’.

Max re energy crops I rely quite heavily on both biodiesel and firewood and I conclude that neither are large scale solutions. About 80% of my car fuel comes from biodiesel made from waste vegetable oil. In winter I heat with firewood and I cook on a wood stove year round. Both the WVO and wood are free because I happen to live close to areas that serve fast food to tourists and to forests. I have yards large enough to store tonnes of wood, drums of oil stacked in rows and neighbours who don’t object. Those factors don’t apply to 99% of the population.

My conclusion from all of this is that current forms of biofuel are limited and remain fossil fuel dependent. For example natural gas is needed to make the methanol catalyst for biodiesel and petroleum diesel runs the forestry industry that creates the firewood byproduct. I believe we should conserve natural gas as a future transport fuel and not burn so much in power stations. When gas is short supply by mid century we might have to make synthetic fuel at great cost. I’m not sure this is even physically possible for a greater world population than today. In short forget energy crops but conserve natural gas instead.

BBD, Mark’s ideas have been discussed extensively, but you could start here:

http://bravenewclimate.com/2011/09/25/coal-dependence-and-the-renewables-paradox/

http://bravenewclimate.com/2010/05/22/tcase10/